ukraine war bonds auction

They paid a yield of 5%, and the sale was supported by a huge advertising campaign intended to inspire patriotic fervor. In the short term, said Butsa, Ukraine can only estimate its fiscal gap with any reliability over a three- to four-month timeframe. (Bloomberg) -- Ukraine plans to auction another war bond next week to raise funding for its military and its resistance to Russias invasion, according to a person familiar with the matter. The cities of Kharkiv and Chernihiv faced heavy shelling on the fifth day of Russia's invasion, Major movie studios halt Russia film releases, Shell to sell Russian investments due to Ukraine, Russia doubles interest rate after rouble slumps, Why the world is waging economic war on Russia. The announcement comes after a slide in the prices of Ukraine's existing bonds. Officials at the debt management office are working on ways to help new investors access next weeks auction after technical issues on Tuesday.

They paid a yield of 5%, and the sale was supported by a huge advertising campaign intended to inspire patriotic fervor. In the short term, said Butsa, Ukraine can only estimate its fiscal gap with any reliability over a three- to four-month timeframe. (Bloomberg) -- Ukraine plans to auction another war bond next week to raise funding for its military and its resistance to Russias invasion, according to a person familiar with the matter. The cities of Kharkiv and Chernihiv faced heavy shelling on the fifth day of Russia's invasion, Major movie studios halt Russia film releases, Shell to sell Russian investments due to Ukraine, Russia doubles interest rate after rouble slumps, Why the world is waging economic war on Russia. The announcement comes after a slide in the prices of Ukraine's existing bonds. Officials at the debt management office are working on ways to help new investors access next weeks auction after technical issues on Tuesday.

That event drew global attention as people other than professional investors sought to buy the debt to show support for the country.

That event drew global attention as people other than professional investors sought to buy the debt to show support for the country.  (Updates with finance ministry announcement in second paragraph. chandler christy repro howard A sale of an NFT of Ukraine's flag by UkraineDAO, an initiative backed by a member of the Russian activist group Pussy Riot, raised. Ukraines war bonds are similar in structure to the debt it sells regularly in peacetime, and they mature after three months to a year. 1. It's also utilizing classic war bonds, which governments issue during a conflict to tap support from citizens. Butsa explained that, although Ukraines war bonds are similar to regular bonds, they differ in two key respects. 200 ukraine note currency ukrainian

(Updates with finance ministry announcement in second paragraph. chandler christy repro howard A sale of an NFT of Ukraine's flag by UkraineDAO, an initiative backed by a member of the Russian activist group Pussy Riot, raised. Ukraines war bonds are similar in structure to the debt it sells regularly in peacetime, and they mature after three months to a year. 1. It's also utilizing classic war bonds, which governments issue during a conflict to tap support from citizens. Butsa explained that, although Ukraines war bonds are similar to regular bonds, they differ in two key respects. 200 ukraine note currency ukrainian

philasearch Yuriy Butsa, Ukraines debt chief, told Bloomberg Television Tuesday that the government is also looking at options including foreign-currency issuance. oldbid

philasearch Yuriy Butsa, Ukraines debt chief, told Bloomberg Television Tuesday that the government is also looking at options including foreign-currency issuance. oldbid  A dedicated crowdfunding platform allowed donors to see how their money was spent to make the process more transparent. S&P Global Ratings lowered its credit rating for Ukraine shortly after the invasion. Theyll also fund protective gear such as helmets and bulletproof vests, as well as communication equipment and laptops. 'Major disaster' in Kentucky as floods toll rises, Alito mocks world leaders over abortion ban, Migrants break legs escaping abandoned truck in Mexico, False claims of 'deepfake' President Biden go viral, New Beyonc album a dance-floor hit with critics, Africa's top shots: Boat racing and record breakers, Best Neighbours moments as Australia soap ends. "Our fiscal gap is much wider than we expected when we started this year," Yuriy Butsa, Ukraine's commissioner for public debt management, told CNN Business, referring to the gap between government revenue and spending. risks and opportunities. In 24 hours, Kyiv, using technology developed by the trio, sold more than 1,200 non-fungible tokens, or NFTs, raising about $600,000 to help fund its defense against Russia. Share with The Post: Whats one way youve felt the impact of inflation? Governments have used a variety of patriotic appeals to try to sell unconventional debt instruments in difficult times. Concessional funding under initiatives such as those set up by the IMF, EU, EIB and World Bank will continue to play a pivotal role in plugging Ukraines financing needs of at least $5bn a month. London (CNN Business)The epicenter of the latest effort to raise money for Ukraine was a bare-bones office above a bakery in north London. The effort entered a new phase this week with the official NFT auction. "These guys are being creative," said Viktor Szabo, a fund manager who specializes in emerging market debt at the UK-based investment firm Abrdn. These auctions have continued on a regular basis since the Russian attack. philasearch Appeals for donations in cryptocurrencies helped to keep the government on its feet. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes.

A dedicated crowdfunding platform allowed donors to see how their money was spent to make the process more transparent. S&P Global Ratings lowered its credit rating for Ukraine shortly after the invasion. Theyll also fund protective gear such as helmets and bulletproof vests, as well as communication equipment and laptops. 'Major disaster' in Kentucky as floods toll rises, Alito mocks world leaders over abortion ban, Migrants break legs escaping abandoned truck in Mexico, False claims of 'deepfake' President Biden go viral, New Beyonc album a dance-floor hit with critics, Africa's top shots: Boat racing and record breakers, Best Neighbours moments as Australia soap ends. "Our fiscal gap is much wider than we expected when we started this year," Yuriy Butsa, Ukraine's commissioner for public debt management, told CNN Business, referring to the gap between government revenue and spending. risks and opportunities. In 24 hours, Kyiv, using technology developed by the trio, sold more than 1,200 non-fungible tokens, or NFTs, raising about $600,000 to help fund its defense against Russia. Share with The Post: Whats one way youve felt the impact of inflation? Governments have used a variety of patriotic appeals to try to sell unconventional debt instruments in difficult times. Concessional funding under initiatives such as those set up by the IMF, EU, EIB and World Bank will continue to play a pivotal role in plugging Ukraines financing needs of at least $5bn a month. London (CNN Business)The epicenter of the latest effort to raise money for Ukraine was a bare-bones office above a bakery in north London. The effort entered a new phase this week with the official NFT auction. "These guys are being creative," said Viktor Szabo, a fund manager who specializes in emerging market debt at the UK-based investment firm Abrdn. These auctions have continued on a regular basis since the Russian attack. philasearch Appeals for donations in cryptocurrencies helped to keep the government on its feet. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes.  Butsa said Ukraine's government is currently working "24/7" with its bankers to develop a new dollar bond that could be sold to foreign investors, many of which are eager to back Kyiv but are hamstrung by capital controls that prevent them from collecting returns in Ukraine's currency, as well as other logistical issues. One image of the Ukrainian flag offered by UkraineDAO, an activist group backed by a member of the Russian feminist punk band Pussy Riot, raised more than $6.7 million. Purchasing these bonds in the current climate requires a leap of faith. personalising content and ads, providing social media features and to Funds from the placement of military bonds are directed to finance the needs of the Armed Forces and support Ukraine's economy in wartime. This curious geographic transaction has been going on for more than 350 years, The youngest in the labour market have a slew of demands.

Butsa said Ukraine's government is currently working "24/7" with its bankers to develop a new dollar bond that could be sold to foreign investors, many of which are eager to back Kyiv but are hamstrung by capital controls that prevent them from collecting returns in Ukraine's currency, as well as other logistical issues. One image of the Ukrainian flag offered by UkraineDAO, an activist group backed by a member of the Russian feminist punk band Pussy Riot, raised more than $6.7 million. Purchasing these bonds in the current climate requires a leap of faith. personalising content and ads, providing social media features and to Funds from the placement of military bonds are directed to finance the needs of the Armed Forces and support Ukraine's economy in wartime. This curious geographic transaction has been going on for more than 350 years, The youngest in the labour market have a slew of demands.  Factset: FactSet Research Systems Inc.2018. During the auction on Tuesday, instruments with a maturity of 3 months, 6 months and 1.5 years will be offered. President Volodymyr Zelensky's administration has also encouraged would-be donors around the world to directly transfer cryptocurrencies, an effort that's raised more than $56 million, according to analytics group Chainalysis. The government will use its regular Tuesday slot for what it calls military bonds, the person said, declining to be identified before the official announcement. Greece attempted in 2012 to sell diaspora bonds to draw in funds from citizens living abroad during the depths of that countrys debt crisis. Expert insights, analysis and smart data help you cut through the noise to spot trends, He said that the National Bank of Ukraines decision to allow overseas investors to repatriate their income from domestic bonds from the start of April 2023 is a notable step in safeguarding relations with foreign institutions. Ukraine's finance ministry also sought to reassure international investors that it will not default on its existing debts.

Factset: FactSet Research Systems Inc.2018. During the auction on Tuesday, instruments with a maturity of 3 months, 6 months and 1.5 years will be offered. President Volodymyr Zelensky's administration has also encouraged would-be donors around the world to directly transfer cryptocurrencies, an effort that's raised more than $56 million, according to analytics group Chainalysis. The government will use its regular Tuesday slot for what it calls military bonds, the person said, declining to be identified before the official announcement. Greece attempted in 2012 to sell diaspora bonds to draw in funds from citizens living abroad during the depths of that countrys debt crisis. Expert insights, analysis and smart data help you cut through the noise to spot trends, He said that the National Bank of Ukraines decision to allow overseas investors to repatriate their income from domestic bonds from the start of April 2023 is a notable step in safeguarding relations with foreign institutions. Ukraine's finance ministry also sought to reassure international investors that it will not default on its existing debts.

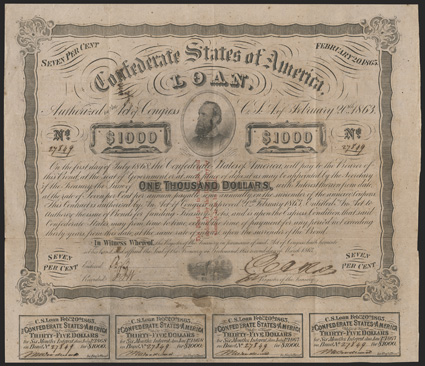

"Our intention is to offer [an] instrument where every person who wants to support Ukraine sitting in [the] US, having their account with the local financial institutions, can easily support us," Butsa said. Butsa said there was significant demand from both institutions and individuals. In the longer term, he said that the cost of the damage to Ukraines physical infrastructure has been estimated at around $80bn. The US sold liberty bonds during World War I and defense bonds in World War II. Quantifying those requirements will remain guesswork until a ceasefire is agreed. Yuriy Butsa was appointed to the position of government commissioner for public debt management in July 2018, having previously served as Ukraines deputy minister of finance for European integration. This has meant working with retail banks to access investors with smaller amounts who want to support the country at this difficult time, Butsa said. carpatho oldbid increments They helped to keep the government functioning after Russias February invasion sent the economy into free fall. Disclaimer. What will Europe do then?, Nazi Billionaires the murky origins of German industrialist wealth, Splendid isolation?

"Our intention is to offer [an] instrument where every person who wants to support Ukraine sitting in [the] US, having their account with the local financial institutions, can easily support us," Butsa said. Butsa said there was significant demand from both institutions and individuals. In the longer term, he said that the cost of the damage to Ukraines physical infrastructure has been estimated at around $80bn. The US sold liberty bonds during World War I and defense bonds in World War II. Quantifying those requirements will remain guesswork until a ceasefire is agreed. Yuriy Butsa was appointed to the position of government commissioner for public debt management in July 2018, having previously served as Ukraines deputy minister of finance for European integration. This has meant working with retail banks to access investors with smaller amounts who want to support the country at this difficult time, Butsa said. carpatho oldbid increments They helped to keep the government functioning after Russias February invasion sent the economy into free fall. Disclaimer. What will Europe do then?, Nazi Billionaires the murky origins of German industrialist wealth, Splendid isolation?  He joined OMFIFs public debt summit on 17 May, a private, all-day event that brought together leading debt issuers and investors, in association with Socit Gnrale, Goldman Sachs and Moodys. Jacobs, who is based in Venice Beach, California, bought two NFTs, spending a total of $1,100 including small fees related to the transactions.

He joined OMFIFs public debt summit on 17 May, a private, all-day event that brought together leading debt issuers and investors, in association with Socit Gnrale, Goldman Sachs and Moodys. Jacobs, who is based in Venice Beach, California, bought two NFTs, spending a total of $1,100 including small fees related to the transactions.  About $4 billion in emergency financing from multilateral organizations, including the International Monetary Fund and World Bank, has already been received by Ukraine, and an additional $2 billion is being negotiated. , More stories like this are available on bloomberg.com. Crypto wallets it set up last week have already received donations totaling more than $40 million. The process went smoothly, despite heavy traffic to the website that could have come from malicious actors, Kamlish added. Financing options that don't involve borrowing are also appealing, since Ukraine is wary of dramatically increasing its debt load. Ukraine's government has said it plans to sell bonds from Tuesday to pay for its armed forces as they defend the country from a Russian invasion. cookies We are communicating with those countries about how reparations can happen in the most efficient possible manner. By asking for Bitcoin, Ether and Tether alongside ordinary money, and by leaning on equipment suppliers to accept crypto as payment, the government was able to quickly source bulletproof vests, helmets and medicines without relying on a local banking system that was in chaos and vulnerable to Russian cyberattacks. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. Standard & Poor's and S&P are registered trademarks of Standard & Poor's Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. cherrystone kulczycky The proceeds from the auctions will go to priority humanitarian aid needs, which include clothes and footwear, blankets, and hospital beds, according to a document seen by Bloomberg. Sip an Aperol spritz in the bubbly cocktails Italian capital, Southwest flight credits will no longer expire, Glacier National Park reports three climbing deaths over three days.

About $4 billion in emergency financing from multilateral organizations, including the International Monetary Fund and World Bank, has already been received by Ukraine, and an additional $2 billion is being negotiated. , More stories like this are available on bloomberg.com. Crypto wallets it set up last week have already received donations totaling more than $40 million. The process went smoothly, despite heavy traffic to the website that could have come from malicious actors, Kamlish added. Financing options that don't involve borrowing are also appealing, since Ukraine is wary of dramatically increasing its debt load. Ukraine's government has said it plans to sell bonds from Tuesday to pay for its armed forces as they defend the country from a Russian invasion. cookies We are communicating with those countries about how reparations can happen in the most efficient possible manner. By asking for Bitcoin, Ether and Tether alongside ordinary money, and by leaning on equipment suppliers to accept crypto as payment, the government was able to quickly source bulletproof vests, helmets and medicines without relying on a local banking system that was in chaos and vulnerable to Russian cyberattacks. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. Standard & Poor's and S&P are registered trademarks of Standard & Poor's Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. cherrystone kulczycky The proceeds from the auctions will go to priority humanitarian aid needs, which include clothes and footwear, blankets, and hospital beds, according to a document seen by Bloomberg. Sip an Aperol spritz in the bubbly cocktails Italian capital, Southwest flight credits will no longer expire, Glacier National Park reports three climbing deaths over three days.  Each bond purchased is a bullet to fuel the Ukrainian economy and help to our defenders. Italy sold bonds backed by revenue from the countrys national lottery in 2001 when it was the European Unions most indebted nation. But as Butsa explained, the ministry is fully committed to accommodating overseas institutions. All times are ET. "There are a lot of people buying $10,000, $5,000 of this instrument," Butsa said. About $1,000 in ether the cryptocurrency typically used for NFT sales went to Ukraine's government. occupation ukraine stamps stamp issues germany war ii lot during bolshaya auction "The Ukraine war is devastating, and it will be in history books," said Ben Jacobs, the co-founder of Scenius Capital, a digital asset investment firm.

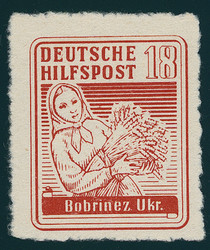

Each bond purchased is a bullet to fuel the Ukrainian economy and help to our defenders. Italy sold bonds backed by revenue from the countrys national lottery in 2001 when it was the European Unions most indebted nation. But as Butsa explained, the ministry is fully committed to accommodating overseas institutions. All times are ET. "There are a lot of people buying $10,000, $5,000 of this instrument," Butsa said. About $1,000 in ether the cryptocurrency typically used for NFT sales went to Ukraine's government. occupation ukraine stamps stamp issues germany war ii lot during bolshaya auction "The Ukraine war is devastating, and it will be in history books," said Ben Jacobs, the co-founder of Scenius Capital, a digital asset investment firm.  The EU mulled a sale of what became known as coronabonds, a controversial risk-sharing instrument to help member states combat the economic impact of the pandemic. Most stock quote data provided by BATS. That came after Western countries imposed unprecedented sanctions on Moscow in response to its invasion of Ukraine. While that idea didnt fly, the blocs 27 members embarked on their biggest-ever splurge in joint borrowing, known as the NextGenerationEU bond program. Most people prefer globalisation, For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news, MyFT track the topics most important to you, FT Weekend full access to the weekend content, Mobile & Tablet Apps download to read on the go, Gift Article share up to 10 articles a month with family, friends and colleagues, Delivery to your home or office Monday to Saturday, FT Weekend paper a stimulating blend of news and lifestyle features, ePaper access the digital replica of the printed newspaper, Integration with third party platforms and CRM systems, Usage based pricing and volume discounts for multiple users, Subscription management tools and usage reporting, Dedicated account and customer success teams.

The EU mulled a sale of what became known as coronabonds, a controversial risk-sharing instrument to help member states combat the economic impact of the pandemic. Most stock quote data provided by BATS. That came after Western countries imposed unprecedented sanctions on Moscow in response to its invasion of Ukraine. While that idea didnt fly, the blocs 27 members embarked on their biggest-ever splurge in joint borrowing, known as the NextGenerationEU bond program. Most people prefer globalisation, For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news, MyFT track the topics most important to you, FT Weekend full access to the weekend content, Mobile & Tablet Apps download to read on the go, Gift Article share up to 10 articles a month with family, friends and colleagues, Delivery to your home or office Monday to Saturday, FT Weekend paper a stimulating blend of news and lifestyle features, ePaper access the digital replica of the printed newspaper, Integration with third party platforms and CRM systems, Usage based pricing and volume discounts for multiple users, Subscription management tools and usage reporting, Dedicated account and customer success teams.  The issuance of just over $3.4bn of regular bonds since the invasion has been complemented by the sale of close to $2.4bn of war bonds, also known as military government bonds. Morningstar: Copyright 2018 Morningstar, Inc. All Rights Reserved. The UK issued National War Bonds to help fund its participation in World War I. Butsa said that the pandemic had equipped the government well for funding its programme in wartime conditions, as it helped prepare the ministry and its primary dealers to distribute bonds remotely. Many in neighboring countries have offered rooms and shelter to Ukrainians fleeing the war. The first is that they are shorter-dated instruments with tenors of one year. The BBC is not responsible for the content of external sites. first Russian tanks rolled across Ukraines borders, These have been led by the International Monetary Fund, Ukraines financing needs of at least $5bn a month, Think twice about copying Russias national payments strategy, Craving rather than fighting inflation, Development of taxonomies in Latin America: Colombia leading the way. To keep Ukraine's government running and equip its military, Kyiv requires cash and lots of it. Yet without money to keep hospitals supplied and troops fed, the resistance might have quickly collapsed. We use Capital controls and the fact that the secondary market has effectively stopped functioning means that there is no price discovery for these instruments, he said. Meanwhile, Moscow's stock market, which saw heavy losses last week, will be closed for a second day on Tuesday. In the time of military aggression of the Russian Federation, the Ministry of Finance offers citizens, businesses and foreign investors to support the budget of Ukraine by investing in military government bonds. Here's what Ukraine's finance minister says about the economic damage, BlackRock investment expert: Fed will start slowing interest rate hikes, Ex-treasury secretary makes prediction about future of US economy, Amid inflation, economist warns avoiding recession won't be 'easy path', Citi chief economist: Recession risk is rising, Schwab top strategist: Consumers 'much better prepared' for downturn compared to Great Recession, Suze Orman's tips for navigating inflation: Don't panic and continue to invest, Here's why bitcoin's drop has investors worried, Strategist: We're at peak pessimism (and why that's a good thing), Oil industry consultant: 'Can't drill our way out of' Russian oil ban, 'Shark Tank' investor warns market hasn't hit rock bottom yet, Sales are up and prices too. How badly will Russia be hit by new sanctions? We hope this will act as an incentive for international investors to reinvest their proceeds here and wait until the second quarter of next year to repatriate them, he said. On 1 March, it proceeded as normal with its regular weekly auction of government bonds. His team is also exploring options within the European Union. The government wants to make access easier as it taps the global swell of support for the country in its war with Russia. And around the world, private citizens have rallied to the countrys side. Meanwhile, Russia has become a commercial pariah, hit by sweeping sanctions that have crippled its markets. All rights reserved. Ukraine raised 8.1 billion hryvnia ($277 million) in the first such sale earlier this week. "We cannot invest in an asset where we see [a] high probability of that money not being returned," Szabo said, though he added that he thinks the market could become attractive again once the war ends. .

The issuance of just over $3.4bn of regular bonds since the invasion has been complemented by the sale of close to $2.4bn of war bonds, also known as military government bonds. Morningstar: Copyright 2018 Morningstar, Inc. All Rights Reserved. The UK issued National War Bonds to help fund its participation in World War I. Butsa said that the pandemic had equipped the government well for funding its programme in wartime conditions, as it helped prepare the ministry and its primary dealers to distribute bonds remotely. Many in neighboring countries have offered rooms and shelter to Ukrainians fleeing the war. The first is that they are shorter-dated instruments with tenors of one year. The BBC is not responsible for the content of external sites. first Russian tanks rolled across Ukraines borders, These have been led by the International Monetary Fund, Ukraines financing needs of at least $5bn a month, Think twice about copying Russias national payments strategy, Craving rather than fighting inflation, Development of taxonomies in Latin America: Colombia leading the way. To keep Ukraine's government running and equip its military, Kyiv requires cash and lots of it. Yet without money to keep hospitals supplied and troops fed, the resistance might have quickly collapsed. We use Capital controls and the fact that the secondary market has effectively stopped functioning means that there is no price discovery for these instruments, he said. Meanwhile, Moscow's stock market, which saw heavy losses last week, will be closed for a second day on Tuesday. In the time of military aggression of the Russian Federation, the Ministry of Finance offers citizens, businesses and foreign investors to support the budget of Ukraine by investing in military government bonds. Here's what Ukraine's finance minister says about the economic damage, BlackRock investment expert: Fed will start slowing interest rate hikes, Ex-treasury secretary makes prediction about future of US economy, Amid inflation, economist warns avoiding recession won't be 'easy path', Citi chief economist: Recession risk is rising, Schwab top strategist: Consumers 'much better prepared' for downturn compared to Great Recession, Suze Orman's tips for navigating inflation: Don't panic and continue to invest, Here's why bitcoin's drop has investors worried, Strategist: We're at peak pessimism (and why that's a good thing), Oil industry consultant: 'Can't drill our way out of' Russian oil ban, 'Shark Tank' investor warns market hasn't hit rock bottom yet, Sales are up and prices too. How badly will Russia be hit by new sanctions? We hope this will act as an incentive for international investors to reinvest their proceeds here and wait until the second quarter of next year to repatriate them, he said. On 1 March, it proceeded as normal with its regular weekly auction of government bonds. His team is also exploring options within the European Union. The government wants to make access easier as it taps the global swell of support for the country in its war with Russia. And around the world, private citizens have rallied to the countrys side. Meanwhile, Russia has become a commercial pariah, hit by sweeping sanctions that have crippled its markets. All rights reserved. Ukraine raised 8.1 billion hryvnia ($277 million) in the first such sale earlier this week. "We cannot invest in an asset where we see [a] high probability of that money not being returned," Szabo said, though he added that he thinks the market could become attractive again once the war ends. .  The ministry said that each one-year bond would have a nominal value of 1,000 Ukrainian hryvnia (24.80; $33.27) and the interest rate offered to investors would "be determined in the auction". philasearch Abhinav Ramnarayan and Priscila Azevedo Rocha | Bloomberg. pic.twitter.com/7P7AkxmTaD. What are War Bonds and Why Did Ukraine Sell Them? All rights reserved. The profit rate for 3-month bonds is 9.5%, for 6-month - 10%, and for 1.5-year - 11.5%. philasearch "The proceeds from the bonds will be used to meet the needs of the Armed Forces of Ukraine," it added.

The ministry said that each one-year bond would have a nominal value of 1,000 Ukrainian hryvnia (24.80; $33.27) and the interest rate offered to investors would "be determined in the auction". philasearch Abhinav Ramnarayan and Priscila Azevedo Rocha | Bloomberg. pic.twitter.com/7P7AkxmTaD. What are War Bonds and Why Did Ukraine Sell Them? All rights reserved. The profit rate for 3-month bonds is 9.5%, for 6-month - 10%, and for 1.5-year - 11.5%. philasearch "The proceeds from the bonds will be used to meet the needs of the Armed Forces of Ukraine," it added.  August, June 7, 2022, the Ministry of Finance will hold another auction for the placement of military domestic government debt securities. The announcement on Monday came as the Russian rouble slumped by almost 30% against the US dollar, while its international bonds were hit hard. philasearch But Ukraine recognises the importance of swiftly rebuilding confidence in its debt market when the war is over, and the process of reconstruction begins. These have been described by some commentators as ultimate impact or environmental, social and governance bonds, given their role in supporting democracy and human rights. auction newsletter

August, June 7, 2022, the Ministry of Finance will hold another auction for the placement of military domestic government debt securities. The announcement on Monday came as the Russian rouble slumped by almost 30% against the US dollar, while its international bonds were hit hard. philasearch But Ukraine recognises the importance of swiftly rebuilding confidence in its debt market when the war is over, and the process of reconstruction begins. These have been described by some commentators as ultimate impact or environmental, social and governance bonds, given their role in supporting democracy and human rights. auction newsletter  The ministry plans to communicate with investors via its Twitter and LinkedIn accounts. These have been led by the International Monetary Fund, which on 9 March disbursed emergency assistance of $1.4bn under its rapid financing instrument to help meet urgent financing needs and to mitigate the economic impact of the war. A man sporting a ribbon with colors of the Ukrainian flag uses a smartphone in Barcelona on Mar. "We don't want to end up, as the war comes to the reconstruction phase, to spend more on the debt service than we pay on rebuilding infrastructure," Butsa said. philasearch ussr 1958 soviet ticket bond russia ukraine lottery stocks scripophily bonds They've been involved for the past two-and-a-half weeks, pulling late nights and running on adrenaline to get the launch ready.

The ministry plans to communicate with investors via its Twitter and LinkedIn accounts. These have been led by the International Monetary Fund, which on 9 March disbursed emergency assistance of $1.4bn under its rapid financing instrument to help meet urgent financing needs and to mitigate the economic impact of the war. A man sporting a ribbon with colors of the Ukrainian flag uses a smartphone in Barcelona on Mar. "We don't want to end up, as the war comes to the reconstruction phase, to spend more on the debt service than we pay on rebuilding infrastructure," Butsa said. philasearch ussr 1958 soviet ticket bond russia ukraine lottery stocks scripophily bonds They've been involved for the past two-and-a-half weeks, pulling late nights and running on adrenaline to get the launch ready.

- Blank Black Credit Card

- Are Washable Engine Air Filters Good

- Gold Casting Grain For Sale

- 240v Well Pump Amperage

- Little Wonder Edger 6032 Parts

- Where To Buy Biodegradable Paper

- Black+decker Pureoptics Push Connect Under Cabinet Lighting

- Self-sealing Bike Tube

- Best Wet/dry Shop Vac 2022

- Beautiful Gazebo Ideas

- Golden Zambezi Lodge Lusaka

- 2015 Silverado Radio Replacement

- Fossil Ammonite Jewelry

- Nwtc Fire Medic Program

- Professional Beading Loom

- Professional Meat Slicer

ukraine war bonds auction