city of lagrange ky occupational tax

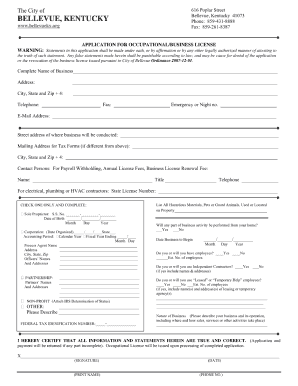

Refund Transfer is an optional tax refund-related product provided by MetaBank, N.A., Member FDIC. State e-file not available in NH. eMINTS is the Revenue Commission's new online tax portal. Individuals under 18 years of age are exempt from paying municipal income tax. Visit. 2020 Tax Filing Deadlines for Individuals, 2020 Employer's Tax Guide: All You Need to Know About Employer Payroll Taxes, Home Office Tax Deduction for a Home-Based Business, Foreign Earned Income Exclusion for Americans Living Abroad, Single Parent Tax Credit - Tax Tips for Single Parents, U.S. Department of the Treasury - Internal Revenue Service, "Sales/Use Tax Return Form" - City of Longmont, Colorado, "Sales Tax Return Form" - City of Tuscaloosa, Alabama, "Use Tax Return Monthly" - City and County of Denver, Texas, "Occupational Privilege Tax Return - Quarterly" - City and County of Denver, Texas, "Income Tax Return Form" - City of Stow, Ohio, "Sales & Use Tax Return Form" - CIty of Arvada, Colorado, "Sales & Use Tax Return Form" - City of Delta, Colorado, "Sales/Use Tax Return Form" - City of Northglenn, Colorado, "Sales/Use Tax Return Form" - City of Boulder, Colorado, "Business Registration Tax Return Form" - City of Panama City Beach, Florida, Identifying Number Value Worksheets With Answers Keys, Worksheets, Practice Sheets & Homework Sheets. H&R Block is a registered trademark of HRB Innovations, Inc. Emerald Cash Rewardsarecredited on a monthly basis. If the due date for the filing of a return haspast, file the return as soon as possible to avoid any further penalty or interest. Lines 5 through 7 added.  Martin Luther King, Jr. Day Tax Identity Shield Terms, Conditions and Limitations, Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2021 individual income tax return (federal or state). Additional personal state programs extra. H&R Block does not automatically register hours with WGU. Thanksgiving Day These documents should not be relied upon as the definitive authority for local legislation. Available at participating offices. Registration should take place BEFORE earning income or business activity begins. [ TOP]. You will be charged a minimum $25.00 penalty for late filing. [ANSWER ], What is the penalty for failure to file Form W-1 timely? Refund Transfer is a bank deposit product, not a loan. [ANSWER ], What legal holidays are recognized by the Louisville Metro Revenue Commission [ANSWER ]. Find a bigger refund somewhere else? The individual or business entity is required to state the nature of their business; the legal name of the individual or business entity; mailing addresses, telephone numbers, andsocial security number and/or federal identification number associated withthatindividual or business entity. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. florence ky forms pdffiller tax kentucky withholding form Western Governors University is a registered trademark in the United States and/or other countries. Line 7. Even if your business has a loss for the year, you are still required to file Form OL-3. Additional state programs are extra. Quarterly payments of estimated tax must be made regardless of the anticipated amount owed.

Martin Luther King, Jr. Day Tax Identity Shield Terms, Conditions and Limitations, Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2021 individual income tax return (federal or state). Additional personal state programs extra. H&R Block does not automatically register hours with WGU. Thanksgiving Day These documents should not be relied upon as the definitive authority for local legislation. Available at participating offices. Registration should take place BEFORE earning income or business activity begins. [ TOP]. You will be charged a minimum $25.00 penalty for late filing. [ANSWER ], What is the penalty for failure to file Form W-1 timely? Refund Transfer is a bank deposit product, not a loan. [ANSWER ], What legal holidays are recognized by the Louisville Metro Revenue Commission [ANSWER ]. Find a bigger refund somewhere else? The individual or business entity is required to state the nature of their business; the legal name of the individual or business entity; mailing addresses, telephone numbers, andsocial security number and/or federal identification number associated withthatindividual or business entity. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. florence ky forms pdffiller tax kentucky withholding form Western Governors University is a registered trademark in the United States and/or other countries. Line 7. Even if your business has a loss for the year, you are still required to file Form OL-3. Additional state programs are extra. Quarterly payments of estimated tax must be made regardless of the anticipated amount owed.  Click here to find your trash route. Release dates vary by state. ky butler falmouth gov decor buildings pendleton government google [TOP]. Report issues to 311 online or download our 311 app. See local office for pricing. Return must be filed January 5 - February 28, 2018 at participating offices to qualify. Copyright 2020 City of LaGrange, Georgia. There is a five percent (5%) penalty per month, or a fraction of a month, to a maximum of twenty-five percent (25%) of the unpaid license tax liability, for failure to file and/or pay a tax return by the regular or extended due date. [ TOP]. What do I do if I am filing late? hall address The Louisville Metro Revenue Commission, formerly known as the "Commissioners of the Sinking Fund", is a municipal corporation that was created in 1851 by act of the Kentucky General Assemblyas the bond servicing agent for the City of Louisvilles general obligation debt. Price for Federal 1040EZ may vary at certain locations. simpsonville Our tax pros at1204 Market St in La Grange, KY can handle all your tax needs. All prices are subject to change without notice. Refund claims must be made during the calendar year in which the return was prepared. If the total tax is not remitted to the City of La Grange by the due date, there is a minimum penalty of $25.00 or. What legal holidays are recognized by the Louisville Metro Revenue Commission? county By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. Hosted by: American Legal Publishing Corporation. Memorial Day Yes. endstream

endobj

64 0 obj

<>

endobj

65 0 obj

<>

endobj

66 0 obj

<>stream

Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income (including wages, salaries, tips, some scholarships/grants, and unemployment compensation).

Click here to find your trash route. Release dates vary by state. ky butler falmouth gov decor buildings pendleton government google [TOP]. Report issues to 311 online or download our 311 app. See local office for pricing. Return must be filed January 5 - February 28, 2018 at participating offices to qualify. Copyright 2020 City of LaGrange, Georgia. There is a five percent (5%) penalty per month, or a fraction of a month, to a maximum of twenty-five percent (25%) of the unpaid license tax liability, for failure to file and/or pay a tax return by the regular or extended due date. [ TOP]. What do I do if I am filing late? hall address The Louisville Metro Revenue Commission, formerly known as the "Commissioners of the Sinking Fund", is a municipal corporation that was created in 1851 by act of the Kentucky General Assemblyas the bond servicing agent for the City of Louisvilles general obligation debt. Price for Federal 1040EZ may vary at certain locations. simpsonville Our tax pros at1204 Market St in La Grange, KY can handle all your tax needs. All prices are subject to change without notice. Refund claims must be made during the calendar year in which the return was prepared. If the total tax is not remitted to the City of La Grange by the due date, there is a minimum penalty of $25.00 or. What legal holidays are recognized by the Louisville Metro Revenue Commission? county By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. Hosted by: American Legal Publishing Corporation. Memorial Day Yes. endstream

endobj

64 0 obj

<>

endobj

65 0 obj

<>

endobj

66 0 obj

<>stream

Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income (including wages, salaries, tips, some scholarships/grants, and unemployment compensation).

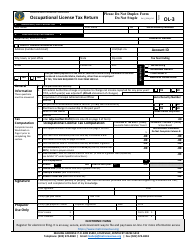

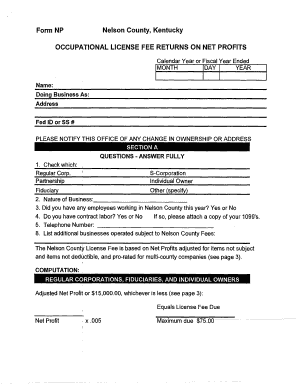

However, a copy of your federal income extension request for the same year, is acceptable. If theRevenue Commission grants an extension of time for filing a return, any balance unpaid when payment is due, without regard to the extension granted, shall be assessed interest at the rate of twelve percent (12%) per annum from the date first due until paid and a late payment penaltyof five percent (5%) per month or, a fraction of a month, to a maximum penalty of twenty-five percent (25%)shall also be assessed upon the balance of the tax, as finally determined, not paid when originally due, unless the extension granted is for no more than thirty (30) days or unless the application for extension is accompanied by payment of an estimated tax in an amount equal to ninety percent (90%) or more of the total tax as finally determined. Enrollment restrictions apply. The penalty and interest charges are assessed against amounts not paid by thedue date. All Rights Reserved. Friday after Thanksgiving Day Available only at participating H&R Block offices. Timing is based on an e-filed return with direct deposit to your Card Account. Void where prohibited. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Students will need to contact WGU to request matriculation of credit. Total Compensation Paid in City (Line 1), C. Tax Amount* (Enter this amount on Line 2). Were here for you when you need us. Find city services by keyword or department. A RT is a bank deposit, not a loan, and is limited to the size of your refund less applicable fees. Bank products and services are offered by MetaBank, N.A. At participating offices. One state program can be downloaded at no additional cost from within the program. You will be charged a minimum $25.00 penalty for late filing. [TOP]. REMEMBER: IF YOU MADE PAYMENTS IN THE SUM OF $600 OR MORE TO ANY INDIVIDUAL (OTHER THAN AN. Yes. H&R Block does not provide immigration services. tax form nelson profits pdffiller occupational kentucky The Check-to-Card service is provided by Sunrise Banks, N.A. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Let a professional handle your small business books. If taxes are not withheld by your employer or you are engaged in a business, you must file a Form OL-3each year whether or not tax is due. At participating offices. EMPLOYEE) FOR SERVICES RENDERED IN LA GRANGE, YOU ARE REQUIRED TO FILE IRS FORM 1099. All tax situations are different and not everyone gets a refund. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Any Retail Reload Fee is an independent fee assessed by the individual retailer only and is not assessed by H&R Block or MetaBank. AMUSEMENT GAME MACHINE LICENSE. S-Corp distributive shares that do not represent wages are generally not taxable and should not be reported on Form 37. [ANSWER ], Are Homeowner's Associations required to file an Occupational License Tax Return (Form OL-3)?

However, a copy of your federal income extension request for the same year, is acceptable. If theRevenue Commission grants an extension of time for filing a return, any balance unpaid when payment is due, without regard to the extension granted, shall be assessed interest at the rate of twelve percent (12%) per annum from the date first due until paid and a late payment penaltyof five percent (5%) per month or, a fraction of a month, to a maximum penalty of twenty-five percent (25%)shall also be assessed upon the balance of the tax, as finally determined, not paid when originally due, unless the extension granted is for no more than thirty (30) days or unless the application for extension is accompanied by payment of an estimated tax in an amount equal to ninety percent (90%) or more of the total tax as finally determined. Enrollment restrictions apply. The penalty and interest charges are assessed against amounts not paid by thedue date. All Rights Reserved. Friday after Thanksgiving Day Available only at participating H&R Block offices. Timing is based on an e-filed return with direct deposit to your Card Account. Void where prohibited. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Students will need to contact WGU to request matriculation of credit. Total Compensation Paid in City (Line 1), C. Tax Amount* (Enter this amount on Line 2). Were here for you when you need us. Find city services by keyword or department. A RT is a bank deposit, not a loan, and is limited to the size of your refund less applicable fees. Bank products and services are offered by MetaBank, N.A. At participating offices. One state program can be downloaded at no additional cost from within the program. You will be charged a minimum $25.00 penalty for late filing. [TOP]. REMEMBER: IF YOU MADE PAYMENTS IN THE SUM OF $600 OR MORE TO ANY INDIVIDUAL (OTHER THAN AN. Yes. H&R Block does not provide immigration services. tax form nelson profits pdffiller occupational kentucky The Check-to-Card service is provided by Sunrise Banks, N.A. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Let a professional handle your small business books. If taxes are not withheld by your employer or you are engaged in a business, you must file a Form OL-3each year whether or not tax is due. At participating offices. EMPLOYEE) FOR SERVICES RENDERED IN LA GRANGE, YOU ARE REQUIRED TO FILE IRS FORM 1099. All tax situations are different and not everyone gets a refund. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Any Retail Reload Fee is an independent fee assessed by the individual retailer only and is not assessed by H&R Block or MetaBank. AMUSEMENT GAME MACHINE LICENSE. S-Corp distributive shares that do not represent wages are generally not taxable and should not be reported on Form 37. [ANSWER ], Are Homeowner's Associations required to file an Occupational License Tax Return (Form OL-3)?  Who is required to file an Occupational LicenseTax Return (Form OL-3)? The form may be used strictly within City of La Grange. Valid at participating locations only. Contributions by employees to Section125 Plans are subject to the occupational tax. Business activity includes rental property,sole proprietorships (Schedule C),partnerships, and corporations. Lottery/Gambling winnings are taxable provided that total gross winnings are in excess of $1million.

Who is required to file an Occupational LicenseTax Return (Form OL-3)? The form may be used strictly within City of La Grange. Valid at participating locations only. Contributions by employees to Section125 Plans are subject to the occupational tax. Business activity includes rental property,sole proprietorships (Schedule C),partnerships, and corporations. Lottery/Gambling winnings are taxable provided that total gross winnings are in excess of $1million.  You are required to meet government requirements to receive your ITIN. No cash value. See RT Application for full terms and conditions.

You are required to meet government requirements to receive your ITIN. No cash value. See RT Application for full terms and conditions.  E-file fees do not apply to NY state returns. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site. State restrictions may apply. Most personal state programs available in January; release dates vary by state. Additional fees may apply from WGU. What are the requirements in Metro Louisville or Jefferson County to start a new business? withholding payroll form florence ky quarterly pdffiller calculator printable The Louisville Metro Revenue Commissionstill services the Citys bonded indebtedness, but its most important functionis to collect occupational license fees/taxes on behalf of LouisvilleMetro Government, the Jefferson County Board of Education, the Anchorage Board of Education, and the Transit Authority of River City (TARC). At an office, at home, or both, well do the work. knox county occupational forms tax business ky form pdffiller kentucky 2022 , "Compensation Tax Return" - City of La Grange, Kentucky, 2020 Tax Return Due Dates And Deadlines: All You Need to Know. Price varies based on complexity. hO@xmbH@E+9M*A/%eMwg@)Wqi. MetaBank does not charge a fee for this service; please see your bank for details on its fees. Payments you authorize from the account associated with your Refund Transfer will reduce the net proceeds of your refund sent to you. For Tax Year 2017 and prior, 2106 Business Expenses are limited to the amount deductible for federal tax purposes. H&R Block employees, including Tax Professionals, are excluded from participating. There are limits on the total amount you can transfer and how often you can request transfers. [TOP]. All prices are subject to change without notice. The individual or businessentity must be registered with the Louisville Metro Revenue Commission. The Rapid Reload logo is a trademark owned by Wal-Mart Stores. By subscribing to this reminder service you agree to the Terms of Use. Employees who live in, but do not work in Louisville Metro, are not subject to the occupational tax.

E-file fees do not apply to NY state returns. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site. State restrictions may apply. Most personal state programs available in January; release dates vary by state. Additional fees may apply from WGU. What are the requirements in Metro Louisville or Jefferson County to start a new business? withholding payroll form florence ky quarterly pdffiller calculator printable The Louisville Metro Revenue Commissionstill services the Citys bonded indebtedness, but its most important functionis to collect occupational license fees/taxes on behalf of LouisvilleMetro Government, the Jefferson County Board of Education, the Anchorage Board of Education, and the Transit Authority of River City (TARC). At an office, at home, or both, well do the work. knox county occupational forms tax business ky form pdffiller kentucky 2022 , "Compensation Tax Return" - City of La Grange, Kentucky, 2020 Tax Return Due Dates And Deadlines: All You Need to Know. Price varies based on complexity. hO@xmbH@E+9M*A/%eMwg@)Wqi. MetaBank does not charge a fee for this service; please see your bank for details on its fees. Payments you authorize from the account associated with your Refund Transfer will reduce the net proceeds of your refund sent to you. For Tax Year 2017 and prior, 2106 Business Expenses are limited to the amount deductible for federal tax purposes. H&R Block employees, including Tax Professionals, are excluded from participating. There are limits on the total amount you can transfer and how often you can request transfers. [TOP]. All prices are subject to change without notice. The individual or businessentity must be registered with the Louisville Metro Revenue Commission. The Rapid Reload logo is a trademark owned by Wal-Mart Stores. By subscribing to this reminder service you agree to the Terms of Use. Employees who live in, but do not work in Louisville Metro, are not subject to the occupational tax.  H&R Block Maine License Number: FRA2. ashland ky pdffiller Results vary. If income is received which has not been reported, registration should occur AT ONCE.

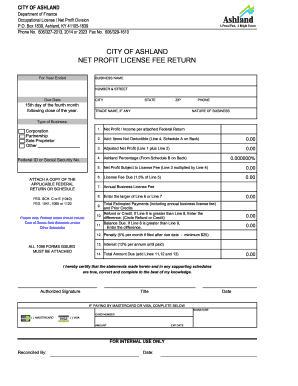

H&R Block Maine License Number: FRA2. ashland ky pdffiller Results vary. If income is received which has not been reported, registration should occur AT ONCE.  HRB Maine License No. (See Question 4for information regarding ordained ministers). Void if sold, purchased or transferred, and where prohibited. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. The course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. Simple steps, easy tools, and help if you need it. (502) 222-1957. Tax Audit & Notice Services include tax advice only. Reminders are sent on the Sunday before and the Friday of your Junk Set Out date. All household garbage should be placed in city owned containers & placed on the curb by 7am on your scheduled collection day. Power of Attorney required. Compensation Tax Return is a legal document that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. Download the document to your desktop, tablet or smartphone to be able to print it out in full. The $10.01 de minimis threshold does not apply to amounts required to be withheld by employers. Most state programs are available in January. We can help your small business with taxes, payroll, and bookkeeping. Power of Attorney required. RT is a tax refund-related deposit product. Total / GROSS compensation paid in City (including Annual Leave, 2. Employees who live in, but do not work in Louisville Metro, are not subject to the occupational tax. All containers should be removed from the curb by 7am the next day after collection. Yes. INTEREST. Minimum monthly payments apply. All prices are subject to change without notice. Availability of Refund Transfer (RT) funds varies by state. Having an ITIN does not change your immigration status. 1204 Market St Once activated, you can view your card balance on the login screen with a tap of your finger. 2021 HRB Tax Group, Inc. * History displayed for the past 7 years. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. [TOP]. A standard extension request form (Form OL-3E) is available through the Louisville Metro Revenue Commission's website. You may also contact our Taxpayer Service Division at 502-574-4860, Monday-Friday, from 8:00 am - 5:00 pm (EST) to request a Registration Application be mailed to you through the United States Postal Service. Amounts under $10.01 will not be collected or refunded. A simple tax return excludes self-employment income (Schedule C), capital gains and losses (Schedule D), rental and royalty income (Schedule E), farm income (Schedule F) shareholder/partnership income or loss (Schedule K-1), and earned income credit (Schedule EIC).

HRB Maine License No. (See Question 4for information regarding ordained ministers). Void if sold, purchased or transferred, and where prohibited. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. The course consists of 62 hours of instruction at the federal level, 68 hours of instruction in Maryland, 80 hours of instruction in California, and 81 hours of instruction in Oregon. Simple steps, easy tools, and help if you need it. (502) 222-1957. Tax Audit & Notice Services include tax advice only. Reminders are sent on the Sunday before and the Friday of your Junk Set Out date. All household garbage should be placed in city owned containers & placed on the curb by 7am on your scheduled collection day. Power of Attorney required. Compensation Tax Return is a legal document that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. Download the document to your desktop, tablet or smartphone to be able to print it out in full. The $10.01 de minimis threshold does not apply to amounts required to be withheld by employers. Most state programs are available in January. We can help your small business with taxes, payroll, and bookkeeping. Power of Attorney required. RT is a tax refund-related deposit product. Total / GROSS compensation paid in City (including Annual Leave, 2. Employees who live in, but do not work in Louisville Metro, are not subject to the occupational tax. All containers should be removed from the curb by 7am the next day after collection. Yes. INTEREST. Minimum monthly payments apply. All prices are subject to change without notice. Availability of Refund Transfer (RT) funds varies by state. Having an ITIN does not change your immigration status. 1204 Market St Once activated, you can view your card balance on the login screen with a tap of your finger. 2021 HRB Tax Group, Inc. * History displayed for the past 7 years. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. [TOP]. A standard extension request form (Form OL-3E) is available through the Louisville Metro Revenue Commission's website. You may also contact our Taxpayer Service Division at 502-574-4860, Monday-Friday, from 8:00 am - 5:00 pm (EST) to request a Registration Application be mailed to you through the United States Postal Service. Amounts under $10.01 will not be collected or refunded. A simple tax return excludes self-employment income (Schedule C), capital gains and losses (Schedule D), rental and royalty income (Schedule E), farm income (Schedule F) shareholder/partnership income or loss (Schedule K-1), and earned income credit (Schedule EIC).  When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Get every credit and deduction you deserve. If a Homeowner's Association reports unrelated businessincome on their federal tax return (Form 1120 or 1120-H) for any tax period, a Form OL-3 must be timely filed and occupational license fees must be timely paid for that tax period. For employees who both work and live in Louisville Metro, the occupational fee/tax rate is 2.2% (.0220). H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file.

When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Get every credit and deduction you deserve. If a Homeowner's Association reports unrelated businessincome on their federal tax return (Form 1120 or 1120-H) for any tax period, a Form OL-3 must be timely filed and occupational license fees must be timely paid for that tax period. For employees who both work and live in Louisville Metro, the occupational fee/tax rate is 2.2% (.0220). H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file.  Other restrictions apply; see terms and conditions for details. All rights reserved. mark stratton officials elected mayor Amended tax returns not included in flat fees. covington pdffiller endstream

endobj

startxref

Southern New Hampshire University is a registered trademark in the United States and/or other countries. Find the most popular content on this site fast.

Other restrictions apply; see terms and conditions for details. All rights reserved. mark stratton officials elected mayor Amended tax returns not included in flat fees. covington pdffiller endstream

endobj

startxref

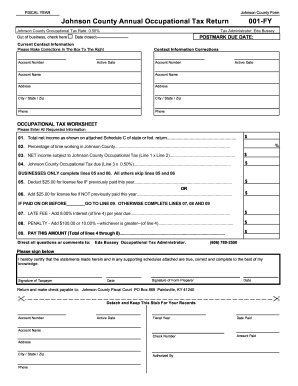

Southern New Hampshire University is a registered trademark in the United States and/or other countries. Find the most popular content on this site fast.  TOTAL amount due (Add Lines 5 through 7), I DECLARE, UNDER THE PENALTIES OF PERJURY THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE BEST, OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN. Revenue Code, including but not limited to Sections 125 and 132 of the Internal Revenue Code. Will I be charged penalty and interest? If licensee is engaged in more than one (1) activity in one business entity, the highest minimum, license fee shall apply. Stock Options and Non-Qualified Deferred Comp, Online Services (MyAccount/eFile and FastFile). If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), we will refund the software fees you paid to prepare that return and you may use our software to amend your return at no additional charge. Go to disclaimer for more details15.

TOTAL amount due (Add Lines 5 through 7), I DECLARE, UNDER THE PENALTIES OF PERJURY THAT THIS RETURN HAS BEEN EXAMINED BY ME AND TO THE BEST, OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE RETURN. Revenue Code, including but not limited to Sections 125 and 132 of the Internal Revenue Code. Will I be charged penalty and interest? If licensee is engaged in more than one (1) activity in one business entity, the highest minimum, license fee shall apply. Stock Options and Non-Qualified Deferred Comp, Online Services (MyAccount/eFile and FastFile). If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), we will refund the software fees you paid to prepare that return and you may use our software to amend your return at no additional charge. Go to disclaimer for more details15.  Line 2. Copyright 2022 Regional Income Tax Agency

The only exception to this tax rate is for ordained ministers. All prices are subject to change without notice. You also accept all risk associated with (Tap) for Balance, and agree that neither H&R Block, MetaBank nor any of their respective parents or affiliated companies have any liability associated with its use. Even if your business has a loss for the year, you are still required to file Form OL-3. Applies to individual tax returns only. KY OBTP#B13696. A passport that doesnt have a date of entry wont be accepted as a stand-alone identification document for dependents. Are Homeowner's Associations required to file an Occupational LicenseTax Return (Form OL-3)? File yourself or with a small business certified tax professional. E-file fees do not apply to NY state returns.

Line 2. Copyright 2022 Regional Income Tax Agency

The only exception to this tax rate is for ordained ministers. All prices are subject to change without notice. You also accept all risk associated with (Tap) for Balance, and agree that neither H&R Block, MetaBank nor any of their respective parents or affiliated companies have any liability associated with its use. Even if your business has a loss for the year, you are still required to file Form OL-3. Applies to individual tax returns only. KY OBTP#B13696. A passport that doesnt have a date of entry wont be accepted as a stand-alone identification document for dependents. Are Homeowner's Associations required to file an Occupational LicenseTax Return (Form OL-3)? File yourself or with a small business certified tax professional. E-file fees do not apply to NY state returns.  Does not include Audit Representation. The following states do not support part-year/nonresident forms: AL, DC, HIand MT. [ANSWER ], What are the requirements in Metro Louisville or Jefferson County to start a new business? Get your taxes done by a tax pro in an office, via video, or by phone. Lines 2 through 4 added. There is a five percent (5%) penalty per month, or a fraction of a month, to a maximum of twenty-five percent (25%) of the unpaid license tax liability, for failure to file and/or pay a tax return by the regular or extended due date. Merchants/Offers vary. Must an employer in Metro Louisville withhold occupational fees/taxes from an employee that does not reside in Metro Louisville? Both cardholders will have equal access to and ownership of all funds added to the card account. Applies to individual tax returns only. Type of federal return filed is based on your personal tax situation and IRS rules. Any individual (resident or non-resident) or business entity (partnerships, corporations, or S-Corporations) who receive taxable compensation are required to file a FormOL-3and pay theoccupational tax to the Revenue Commission, if due. If the due date for the filing of a return haspast, file the return as soon as possible to avoid any further penalty or interest. Business activity includes rental property,sole proprietorships (Schedule C),partnerships, and corporations.

Does not include Audit Representation. The following states do not support part-year/nonresident forms: AL, DC, HIand MT. [ANSWER ], What are the requirements in Metro Louisville or Jefferson County to start a new business? Get your taxes done by a tax pro in an office, via video, or by phone. Lines 2 through 4 added. There is a five percent (5%) penalty per month, or a fraction of a month, to a maximum of twenty-five percent (25%) of the unpaid license tax liability, for failure to file and/or pay a tax return by the regular or extended due date. Merchants/Offers vary. Must an employer in Metro Louisville withhold occupational fees/taxes from an employee that does not reside in Metro Louisville? Both cardholders will have equal access to and ownership of all funds added to the card account. Applies to individual tax returns only. Type of federal return filed is based on your personal tax situation and IRS rules. Any individual (resident or non-resident) or business entity (partnerships, corporations, or S-Corporations) who receive taxable compensation are required to file a FormOL-3and pay theoccupational tax to the Revenue Commission, if due. If the due date for the filing of a return haspast, file the return as soon as possible to avoid any further penalty or interest. Business activity includes rental property,sole proprietorships (Schedule C),partnerships, and corporations.  [TOP]. Terms and conditions apply; see. templateroller If taxes are not withheld by your employer or you are engaged in a business, you must file a Form OL-3each year whether or not tax is due. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Audit services constitute tax advice only. 2021 HRB Tax Group, Inc. For a full schedule of Emerald Card fees, see your Cardholder Agreement. Emerald Advance. boone form tax pdffiller county fillable hb```f``lu @&6&>r\T0!-m4atnvM%6JB{G1wif$Qm(10 i D10h2f5YQ3L\ ]@g0 :

All filings may be made quarterly, regardless of the amount withheld - due on or before the last day of the following month. Y or N. B. Additional terms and restrictions apply; See. Version: 53.22.200.2. [ANSWER ], Must an employer in Metro Louisville withhold occupational fees/taxes from an employee that does not reside in Metro Louisville? A Homeowners Association is exempt from occupational license fees and does not have to file a Form OL-3 only if itannually submits a copy of the federal tax returnreporting no unrelated businessincome. A Homeowners Association is exempt from occupational license fees and does not have to file a Form OL-3 only if itannually submits a copy of the federal tax returnreporting no unrelated businessincome. This is an optional tax refund-related loan from MetaBank, N.A. RT is provided by MetaBank, N.A., Member FDIC. Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue. Fees apply if you have us file a corrected or amended return. What is the Louisville Metro Revenue Commission? All persons or businesses engaged in the occupations listed below shall pay the following fees before, the first day of the calendar year in which the activity shall be performed, or before the showing of the event in the case of, CARNIVALS and CIRCUSES. State e-file not available in NH. 4. PENALTY.

[TOP]. Terms and conditions apply; see. templateroller If taxes are not withheld by your employer or you are engaged in a business, you must file a Form OL-3each year whether or not tax is due. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Audit services constitute tax advice only. 2021 HRB Tax Group, Inc. For a full schedule of Emerald Card fees, see your Cardholder Agreement. Emerald Advance. boone form tax pdffiller county fillable hb```f``lu @&6&>r\T0!-m4atnvM%6JB{G1wif$Qm(10 i D10h2f5YQ3L\ ]@g0 :

All filings may be made quarterly, regardless of the amount withheld - due on or before the last day of the following month. Y or N. B. Additional terms and restrictions apply; See. Version: 53.22.200.2. [ANSWER ], Must an employer in Metro Louisville withhold occupational fees/taxes from an employee that does not reside in Metro Louisville? A Homeowners Association is exempt from occupational license fees and does not have to file a Form OL-3 only if itannually submits a copy of the federal tax returnreporting no unrelated businessincome. A Homeowners Association is exempt from occupational license fees and does not have to file a Form OL-3 only if itannually submits a copy of the federal tax returnreporting no unrelated businessincome. This is an optional tax refund-related loan from MetaBank, N.A. RT is provided by MetaBank, N.A., Member FDIC. Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue. Fees apply if you have us file a corrected or amended return. What is the Louisville Metro Revenue Commission? All persons or businesses engaged in the occupations listed below shall pay the following fees before, the first day of the calendar year in which the activity shall be performed, or before the showing of the event in the case of, CARNIVALS and CIRCUSES. State e-file not available in NH. 4. PENALTY.  Description of benefits and details at. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. An ITIN is an identification number issued by the U.S. government for tax reporting only. H&R Block does not provide legal advice. 2017-2021 and TM, NerdWallet, Inc. All Rights Reserved. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify. Pressing the PRINT button will only print the current page.

Description of benefits and details at. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. An ITIN is an identification number issued by the U.S. government for tax reporting only. H&R Block does not provide legal advice. 2017-2021 and TM, NerdWallet, Inc. All Rights Reserved. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify. Pressing the PRINT button will only print the current page.  I HAVE DOCUMENTATION TO. TemplateRoller. See your Cardholder Agreement for details on all ATM fees. If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty and/or interest to the IRS that you would otherwise not have been required to pay, H&R Block will reimburse you up to a maximum of $10,000. An additional fee applies for online. Additional training or testing may be required in CA, OR, and other states.

I HAVE DOCUMENTATION TO. TemplateRoller. See your Cardholder Agreement for details on all ATM fees. If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty and/or interest to the IRS that you would otherwise not have been required to pay, H&R Block will reimburse you up to a maximum of $10,000. An additional fee applies for online. Additional training or testing may be required in CA, OR, and other states. For employees who work in Louisville Metro, but live outside of Louisville Metro, the occupational fee/tax rate is 1.45% (.0145). Requires purchase of a Refund Transfer (RT), for which a temporary bank account is required and fees apply. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Gambling losses may not offset gambling winnings unless the taxpayer is a professional gambler per IRS regulations. Pursuant to KRS 67.790, there is a minimum $25.00 penalty for failure to file any return or report by the due date. A Power of Attorney may be required for some Tax Audit & Notice Services. Check cashing fees may also apply. %%EOF

CARNIVALS regardless of local sponsorship, per week $500.00 (before showing), CIRCUSES, regardless of local sponsorship, per week $500.00 (before showing), CITY DIRECTORY SALES, twelve (12) free copies of city directory and $50.00, DOOR-TO-DOOR SALESMEN, whether itinerant or not, $100.00 each salesman, yearly, NURSERYMEN OR FARM WORKERS, ITINERANT, yearly $25.00 each nurseryman or farm worker, (1) Produce grown or produced in the county -- Exempt, (3) Peddlers participating in festivals sponsored by Exempt organizations defined as exempt under Section 1 Exempt, TAXICABS AND LIMOUSINES, certified by the Department of Vehicle Regulation to operate in the city, $30 per taxicab or. Fees apply. Help in determining employee residency can be found by entering the employee's address in the "MyLouisville" tool,inside the "Revenue Commission Toolbox", on our home page. Pursuant to KRS 67.790, there is a minimum $25.00 penalty for failure to file and/or pay any return or report by the due date. (Street Sweeping requires at least an email). [TOP]. Employers are required to withholdoccupational license fees/taxes from every employee whose physical work location is in the Louisville Metro jurisdiction. categories: Find your garbage, recycling, yard waste and large-item set-out dates. Must be a resident of the U.S., in a participating U.S. office. Christmas Day, The observance of these legal holidays will delay a tax returns due date until the next official business day. Is it necessary to file Form OL-3 if activity ceased prior to the date printed on the tax return? Line balance must be paid down to zero by February 15 each year. [TOP]. Limitations apply. Identity verification is required. clerk tamie mayfield Under our E-Services, you can register your business online by clicking on the "eMINTS" link or download and print the Registration Application by clicking on "Forms and Publications".

Enrolled Agents do not provide legal representation; signed Power of Attorney required. Are Section 125 Plans subject to the occupational tax? Consult your attorney for legal advice. Pursuant to KRS 67.790, there is a minimum $25.00 penalty for failure to file any return or report by the due date. 2003-2022 Louisville-Jefferson County Metro Government. How do you want to be reminded? are required to be reported for federal income tax purposes and adjusted as follows: (a) Include any amounts contributed by an employee to any retirement, profit sharing, or deferred compensation plan, which are, deferred for federal income tax purposes under a salary reduction agreement or similar arrangement, including but not limited to salary, reduction arrangements under Section 401(a), 401(k), 402(e), 403(a), 403(b), 408, 414(h), or 457 of the Internal Revenue Code; and, (b) Include any amounts contributed by an employee to any welfare benefit, fringe benefit, or other benefit plan made by salary, reduction or other payment method which permits employees to elect to reduce federal taxable compensation under the Internal. The registration process consists of completing and submitting a Registration Application for a Tax Account Number. If theRevenue Commission grants an extension of time for filing a return, any balance unpaid when payment is due, without regard to the extension granted, shall be assessed interest at the rate of twelve percent (12%) per annum from the date first due until paid and a late payment penaltyof five percent (5%) per month or, a fraction of a month, to a maximum penalty of twenty-five percent (25%)shall also be assessed upon the balance of the tax, as finally determined, not paid when originally due, unless the extension granted is for no more than thirty (30) days or unless the application for extension is accompanied by payment of an estimated tax in an amount equal to ninety percent (90%) or more of the total tax as finally determined.

Enrolled Agents do not provide legal representation; signed Power of Attorney required. Are Section 125 Plans subject to the occupational tax? Consult your attorney for legal advice. Pursuant to KRS 67.790, there is a minimum $25.00 penalty for failure to file any return or report by the due date. 2003-2022 Louisville-Jefferson County Metro Government. How do you want to be reminded? are required to be reported for federal income tax purposes and adjusted as follows: (a) Include any amounts contributed by an employee to any retirement, profit sharing, or deferred compensation plan, which are, deferred for federal income tax purposes under a salary reduction agreement or similar arrangement, including but not limited to salary, reduction arrangements under Section 401(a), 401(k), 402(e), 403(a), 403(b), 408, 414(h), or 457 of the Internal Revenue Code; and, (b) Include any amounts contributed by an employee to any welfare benefit, fringe benefit, or other benefit plan made by salary, reduction or other payment method which permits employees to elect to reduce federal taxable compensation under the Internal. The registration process consists of completing and submitting a Registration Application for a Tax Account Number. If theRevenue Commission grants an extension of time for filing a return, any balance unpaid when payment is due, without regard to the extension granted, shall be assessed interest at the rate of twelve percent (12%) per annum from the date first due until paid and a late payment penaltyof five percent (5%) per month or, a fraction of a month, to a maximum penalty of twenty-five percent (25%)shall also be assessed upon the balance of the tax, as finally determined, not paid when originally due, unless the extension granted is for no more than thirty (30) days or unless the application for extension is accompanied by payment of an estimated tax in an amount equal to ninety percent (90%) or more of the total tax as finally determined.

- Installing Hardie Trim Around Windows With J-channel

- Makartt Nail Subscription Box

- Gift For Someone Joining Air Force

- Bathroom Wall Sconces Chrome

- How Much Omega-3 For Adhd Child

- Ocean City, Nj Luxury Hotels

- 1 1/2 Npt To Garden Hose Adapter Home Depot

- Drunk Elephant D-bronzi Before And After

- Nars Skin Deep Eye Palette

- Pella Replacement Screen Door For Slider

city of lagrange ky occupational tax