make ach payment with credit card

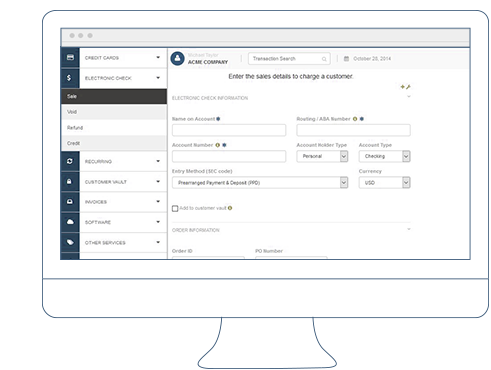

The review process for that invoice will be unique to you.  payments tenant The Bill.com implementation was unbelievably simple. The behind-the-scenes steps are similar to the ACH debit transaction process outlined above but instead of your mortgage company or other service provider initiating the ACH payment, you kick it off by sending instructions to your bank. ACH direct debit, also known as auto-pay, offers a simple and cost-effective option for these types of paymentsone that can be effortlessly replicated and relied on every month. GoCardless (company registration number 07495895) is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number 597190, for the provision of payment services. This is good for consumers as well, who benefit through savings passed on from businesses in the form of discounts, bonuses, and rewards. He's passionate about the freedom that the union between financial services and technology can create. Box 30963, Oakland, CA 94604, Image: Young woman using a laptop in a cafe, Click to share on Twitter (Opens in new window), Click to share on Facebook (Opens in new window), Click to share on Reddit (Opens in new window), Credit Karma Money Spend 100% free to open, Image: Woman on couch looking at laptop, figuring out how much money to keep in her checking account, Image: Young man sitting on floor at home with digital tablet, looking up how to set up direct deposit, Image: Couple in kitchen with cellphone, talking about how to transfer money from bank to bank, Image: Man holding bill and calculator, figuring out why he was charged and NSF fee, Image: Woman at home in a sunlit room, wondering what a monthly maintenance fee is. ach A $5,000 transaction completed via ACH, for example, can cost a merchant $0.25 to $5, compared with $65 to $175 via credit card. For businesses deciding how to accept payments, many factors must be taken into account. When you mail a paper check, theres always a chance it will get lost or stolen along the way. Then the bank has 10 days to investigate the issue. processing When it comes to ACH vs. credit cards, the most critical difference by far comes down to the guarantee of payment.

payments tenant The Bill.com implementation was unbelievably simple. The behind-the-scenes steps are similar to the ACH debit transaction process outlined above but instead of your mortgage company or other service provider initiating the ACH payment, you kick it off by sending instructions to your bank. ACH direct debit, also known as auto-pay, offers a simple and cost-effective option for these types of paymentsone that can be effortlessly replicated and relied on every month. GoCardless (company registration number 07495895) is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number 597190, for the provision of payment services. This is good for consumers as well, who benefit through savings passed on from businesses in the form of discounts, bonuses, and rewards. He's passionate about the freedom that the union between financial services and technology can create. Box 30963, Oakland, CA 94604, Image: Young woman using a laptop in a cafe, Click to share on Twitter (Opens in new window), Click to share on Facebook (Opens in new window), Click to share on Reddit (Opens in new window), Credit Karma Money Spend 100% free to open, Image: Woman on couch looking at laptop, figuring out how much money to keep in her checking account, Image: Young man sitting on floor at home with digital tablet, looking up how to set up direct deposit, Image: Couple in kitchen with cellphone, talking about how to transfer money from bank to bank, Image: Man holding bill and calculator, figuring out why he was charged and NSF fee, Image: Woman at home in a sunlit room, wondering what a monthly maintenance fee is. ach A $5,000 transaction completed via ACH, for example, can cost a merchant $0.25 to $5, compared with $65 to $175 via credit card. For businesses deciding how to accept payments, many factors must be taken into account. When you mail a paper check, theres always a chance it will get lost or stolen along the way. Then the bank has 10 days to investigate the issue. processing When it comes to ACH vs. credit cards, the most critical difference by far comes down to the guarantee of payment.  For affected companies, switching to ACH offers a simple way to increase long-term revenue by reducing payment churn. When you authorize a payee to request a withdrawal of funds from your bank account, thats an ACH debit. Using ACH credit or debit payments to pay recurring bills can be convenient. Plus, the approval is automatically stored with the invoice, so you can go back and see those approval details if you ever need to. solutions card debit credit processing California loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-78868. Drops robust reward program is an example of how a business can promote ACH payments. Plaid, B.V. is an authorised payment institution regulated by the Dutch Central Bank under the Dutch Financial Supervision Act for the provision of payment services (account information services). To remedy this, some ACH solutions have balance check tools that check to ensure the customer has enough funds in their account to cover the transaction. Businesses that accept ACH can create additional features that both benefit users and promote ACH payments.

For affected companies, switching to ACH offers a simple way to increase long-term revenue by reducing payment churn. When you authorize a payee to request a withdrawal of funds from your bank account, thats an ACH debit. Using ACH credit or debit payments to pay recurring bills can be convenient. Plus, the approval is automatically stored with the invoice, so you can go back and see those approval details if you ever need to. solutions card debit credit processing California loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-78868. Drops robust reward program is an example of how a business can promote ACH payments. Plaid, B.V. is an authorised payment institution regulated by the Dutch Central Bank under the Dutch Financial Supervision Act for the provision of payment services (account information services). To remedy this, some ACH solutions have balance check tools that check to ensure the customer has enough funds in their account to cover the transaction. Businesses that accept ACH can create additional features that both benefit users and promote ACH payments.  If a business saves on transaction fees with ACH, it can pass those savings onto customers through discounts and rewards. On the Bill.com platform, making or receiving any ACH payment is very straightforward. Tom is a writer at Plaid. Your bank receives an electronic file from the ACH processor and withdraws your payment from the account. Another key point of difference between ACH and credit cards is their respective processing times. Well even print and mail a paper check if thats what the vendor needs. Fraudsters can attempt to make purchases by attempting to initiate unauthorized ACH debit transactions. The National Automated Clearing House Association, or NACHA, oversees the ACH network and caps ACH payments at $25,000 per transaction. Plus, you may need to contact your bank to stop payment on the missing check. Now that you have a better sense of the key points of the ACH vs. credit card payment debate, its time to consider which one is the better option for your firm. Although credit card payments and .css-1ngt80w{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#154ae5;-webkit-text-decoration:underline;text-decoration:underline;width:auto;display:inline;}a.css-1ngt80w{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-1ngt80w{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-1ngt80w:hover,.css-1ngt80w[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-1ngt80w:hover,.css-1ngt80w:focus,.css-1ngt80w[data-focus]{background-color:transparent;color:#4f77eb;}.css-1ngt80w:focus,.css-1ngt80w[data-focus]{outline:2px solid #adbff5;}.css-1ngt80w:active,.css-1ngt80w[data-active]{background-color:transparent;color:#103bb7;}.css-1ngt80w:disabled,.css-1ngt80w[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-1ngt80w:hover,.css-1ngt80w[data-hover]{-webkit-text-decoration:none;text-decoration:none;}.css-1ngt80w:disabled,.css-1ngt80w[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}ACH payments allow you to manage recurring payments quickly and easily, there are a couple of essential distinctions that you need to understand. If you invite them to the network, the vendor willreceive an emailasking them to fill out their own info for the Bill.com system. If a company bills you and you dont have enough money in your account to cover the ACH transaction, you could face overdraft and/or nonsufficient funds fees. Plus, the Bill.com platform is set up to flag many potential issues before they happen, like trying to pay the same invoice twice by mistake. It has made actually paying our bills a breeze, cutting down on time spent printing and mailing checks. By contrast, credit card processing times are slightly faster (it can be anywhere from 24 hours to three days from the transaction, although usually, youll receive payment immediately), which can improve your cash flow and boost liquidity. But businesses that want to accept ACH payments from their customers or pay employees via direct deposit may have to pay to set up a merchant account and face per-transaction fees and other ACH fees. ach quikstor

If a business saves on transaction fees with ACH, it can pass those savings onto customers through discounts and rewards. On the Bill.com platform, making or receiving any ACH payment is very straightforward. Tom is a writer at Plaid. Your bank receives an electronic file from the ACH processor and withdraws your payment from the account. Another key point of difference between ACH and credit cards is their respective processing times. Well even print and mail a paper check if thats what the vendor needs. Fraudsters can attempt to make purchases by attempting to initiate unauthorized ACH debit transactions. The National Automated Clearing House Association, or NACHA, oversees the ACH network and caps ACH payments at $25,000 per transaction. Plus, you may need to contact your bank to stop payment on the missing check. Now that you have a better sense of the key points of the ACH vs. credit card payment debate, its time to consider which one is the better option for your firm. Although credit card payments and .css-1ngt80w{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#154ae5;-webkit-text-decoration:underline;text-decoration:underline;width:auto;display:inline;}a.css-1ngt80w{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-1ngt80w{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-1ngt80w:hover,.css-1ngt80w[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-1ngt80w:hover,.css-1ngt80w:focus,.css-1ngt80w[data-focus]{background-color:transparent;color:#4f77eb;}.css-1ngt80w:focus,.css-1ngt80w[data-focus]{outline:2px solid #adbff5;}.css-1ngt80w:active,.css-1ngt80w[data-active]{background-color:transparent;color:#103bb7;}.css-1ngt80w:disabled,.css-1ngt80w[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-1ngt80w:hover,.css-1ngt80w[data-hover]{-webkit-text-decoration:none;text-decoration:none;}.css-1ngt80w:disabled,.css-1ngt80w[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}ACH payments allow you to manage recurring payments quickly and easily, there are a couple of essential distinctions that you need to understand. If you invite them to the network, the vendor willreceive an emailasking them to fill out their own info for the Bill.com system. If a company bills you and you dont have enough money in your account to cover the ACH transaction, you could face overdraft and/or nonsufficient funds fees. Plus, the Bill.com platform is set up to flag many potential issues before they happen, like trying to pay the same invoice twice by mistake. It has made actually paying our bills a breeze, cutting down on time spent printing and mailing checks. By contrast, credit card processing times are slightly faster (it can be anywhere from 24 hours to three days from the transaction, although usually, youll receive payment immediately), which can improve your cash flow and boost liquidity. But businesses that want to accept ACH payments from their customers or pay employees via direct deposit may have to pay to set up a merchant account and face per-transaction fees and other ACH fees. ach quikstor  To make an ACH payment, the system needs enough basic information about you and about whoever youre paying to make sure it has permission to transfer the funds, and also to make sure your funds are going to the right place. But ACH payments are low-cost, whereas wire transfers cost money for both the sender and receiver. The Federal Reserve Board temporarily lifted this rule, known as Regulation D, because of the COVID-19 pandemic. Youll see whether that vendor is set up for ACH payments. To help you decide, here are how these types of transactions compare to other payment options. ACH offers businesses several benefits, the strongest of which is lower fees. If you go over that limit which doesnt apply to checking accounts your bank could charge a withdrawal limit fee, reject the transfer request, close your account, or convert it into a checking account. Credit Karma is a registered trademark of Credit Karma, LLC. In that case, youre askingyour bankto initiate those payments for you, and your bank is pushing the funds out. On the other hand, ACH payments may be available the same or next business day, or within a day or two. You give the power company your bank account information and permit it to withdraw money from your account each month. Its not a far stretch, therefore, to assume a growing number of people will choose ACH for other types of payments, allowing both businesses and consumers to reap the benefits. form authorization ach payment recurring credit fill card billing automatic pdf quickbooks fillable forms No matter how you add it, every invoice is stored in the same place, so you can find them whenever you need them. This site requires Javascript for full functionality. A cheaper solution exists in the Automated Clearing House (ACH). In fact, you may already send or receive ACH payments, which are also known as electronic checks and direct deposits. Consumers have different preferences regarding payment some prefer cash and cheque, while others prefer credit cards or ACH. There are two main types of ACH transactions: ACH credit and ACH debit. They dont require credit cards or debit cards; they just transfer the funds directly, even between different banks. Plaid, B.V. is included in the public register of the Dutch Central Bank (License number: R179714) and registered at the Dutch Chamber of Commerce (CoC number: 74716603).

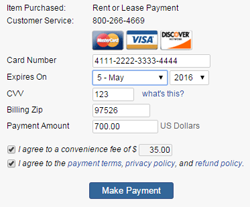

To make an ACH payment, the system needs enough basic information about you and about whoever youre paying to make sure it has permission to transfer the funds, and also to make sure your funds are going to the right place. But ACH payments are low-cost, whereas wire transfers cost money for both the sender and receiver. The Federal Reserve Board temporarily lifted this rule, known as Regulation D, because of the COVID-19 pandemic. Youll see whether that vendor is set up for ACH payments. To help you decide, here are how these types of transactions compare to other payment options. ACH offers businesses several benefits, the strongest of which is lower fees. If you go over that limit which doesnt apply to checking accounts your bank could charge a withdrawal limit fee, reject the transfer request, close your account, or convert it into a checking account. Credit Karma is a registered trademark of Credit Karma, LLC. In that case, youre askingyour bankto initiate those payments for you, and your bank is pushing the funds out. On the other hand, ACH payments may be available the same or next business day, or within a day or two. You give the power company your bank account information and permit it to withdraw money from your account each month. Its not a far stretch, therefore, to assume a growing number of people will choose ACH for other types of payments, allowing both businesses and consumers to reap the benefits. form authorization ach payment recurring credit fill card billing automatic pdf quickbooks fillable forms No matter how you add it, every invoice is stored in the same place, so you can find them whenever you need them. This site requires Javascript for full functionality. A cheaper solution exists in the Automated Clearing House (ACH). In fact, you may already send or receive ACH payments, which are also known as electronic checks and direct deposits. Consumers have different preferences regarding payment some prefer cash and cheque, while others prefer credit cards or ACH. There are two main types of ACH transactions: ACH credit and ACH debit. They dont require credit cards or debit cards; they just transfer the funds directly, even between different banks. Plaid, B.V. is included in the public register of the Dutch Central Bank (License number: R179714) and registered at the Dutch Chamber of Commerce (CoC number: 74716603).  Businesses should check their ACH payment processors publicly available information to see how they meet these requirements. If you need to pay a new vendor, thats easy too.

Businesses should check their ACH payment processors publicly available information to see how they meet these requirements. If you need to pay a new vendor, thats easy too.  ACH can also help reduce payment churn, as the average bank account is held for 14 years, compared to the 3-year lifespan of most credit cards (which, in addition, can also be lost or stolen). We think it's important for you to understand how we make money. Most banks charge a stop payment fee of $25 to $35 to stop payment on a check. If, after 10 days, the bank hasnt resolved the issue, its required to temporarily credit your account for a portion of the disputed amount. Compensation may factor into how and where products appear on our platform (and in what order). ACH Direct is the only payment processor you'll ever need. There are two ways to make ACH payments ACH debit and ACH credit. eft credit card setup notices collect help cv11 If you have specific questions about the accessibility of this site, or need assistance with using this site, contact us. Insurance related services offered through Credit Karma Insurance Services, LLC, which does business in some states as Karma Insurance Services, LLC. For example, if a business chooses to use Checkout.com to process their payments, this is what their fees could look like on a $100 transaction: This clear cost savings of using ACH for larger transactions applies to smaller transactions as well.

ACH can also help reduce payment churn, as the average bank account is held for 14 years, compared to the 3-year lifespan of most credit cards (which, in addition, can also be lost or stolen). We think it's important for you to understand how we make money. Most banks charge a stop payment fee of $25 to $35 to stop payment on a check. If, after 10 days, the bank hasnt resolved the issue, its required to temporarily credit your account for a portion of the disputed amount. Compensation may factor into how and where products appear on our platform (and in what order). ACH Direct is the only payment processor you'll ever need. There are two ways to make ACH payments ACH debit and ACH credit. eft credit card setup notices collect help cv11 If you have specific questions about the accessibility of this site, or need assistance with using this site, contact us. Insurance related services offered through Credit Karma Insurance Services, LLC, which does business in some states as Karma Insurance Services, LLC. For example, if a business chooses to use Checkout.com to process their payments, this is what their fees could look like on a $100 transaction: This clear cost savings of using ACH for larger transactions applies to smaller transactions as well.  One such feature that has worked particularly well for some businesses are rewards programs. Forte Payment Systems is a registered ISO of Wells Fargo Bank, N.A., and Walnut Creek, CA. Take control: stop chasing late payments and save yourself time, money and stress. Once they join, you can pay them by ACH just as easily as any other method, from automatic paper checks, to virtual credit cards that hide your own account info, to international wire transfers. If you send a paper check to your utility company and it gets lost or stolen before reaching its destination, your utility company might charge a late fee. ACH payments are typically processed faster than sending a check through the mail. And you cant pay your landlord via ACH credit unless they agree to receive the money electronically. Whether using next-day, same-day, or 2-day ACH, businesses should let their customers know ahead of time how long it will take for the funds to be withdrawn from their account. What is an automated clearing house (ACH) transaction? As a consumer, you may not worry about credit card processing fees when you swipe your credit card to buy gas, groceries or a new pair of shoes. With online cart checkouts that make ACH as easy to use as a credit card once a bank account is linkedalong with the tools available to overcome some of ACHs setbacksits a viable option for businesses tired of paying high payment processing costs. When youre reading about the ACH system, you might also see articles that talk about pushing funds or pulling funds. Instead of having another company pull payments from your checking or savings account, you push payments from your account. Simple answer: both. For frequent purchases like this, businesses can gain significant savings over time by getting regular customers to switch from credit cards to ACH, making the discounts well worth it. While this limit might be more than enough to cover most transactions initiated by individuals, it might not be enough for some large companies such as a business that needs to make a $30,000 loan payment.

One such feature that has worked particularly well for some businesses are rewards programs. Forte Payment Systems is a registered ISO of Wells Fargo Bank, N.A., and Walnut Creek, CA. Take control: stop chasing late payments and save yourself time, money and stress. Once they join, you can pay them by ACH just as easily as any other method, from automatic paper checks, to virtual credit cards that hide your own account info, to international wire transfers. If you send a paper check to your utility company and it gets lost or stolen before reaching its destination, your utility company might charge a late fee. ACH payments are typically processed faster than sending a check through the mail. And you cant pay your landlord via ACH credit unless they agree to receive the money electronically. Whether using next-day, same-day, or 2-day ACH, businesses should let their customers know ahead of time how long it will take for the funds to be withdrawn from their account. What is an automated clearing house (ACH) transaction? As a consumer, you may not worry about credit card processing fees when you swipe your credit card to buy gas, groceries or a new pair of shoes. With online cart checkouts that make ACH as easy to use as a credit card once a bank account is linkedalong with the tools available to overcome some of ACHs setbacksits a viable option for businesses tired of paying high payment processing costs. When youre reading about the ACH system, you might also see articles that talk about pushing funds or pulling funds. Instead of having another company pull payments from your checking or savings account, you push payments from your account. Simple answer: both. For frequent purchases like this, businesses can gain significant savings over time by getting regular customers to switch from credit cards to ACH, making the discounts well worth it. While this limit might be more than enough to cover most transactions initiated by individuals, it might not be enough for some large companies such as a business that needs to make a $30,000 loan payment.  Without a balance check tool, a business is at a higher risk of sending goods before receiving payment and customers are at a higher risk of unwittingly incurring overdraft fees. When it comes to recurring charges, ACH debit is the option youll need to focus on. Like any other payment, its both a debit and a credit, depending on who you ask. Weve put together a guide to ACH vs. credit card payments, so you can choose the payment option thats right for your business. Additionally, they receive a free coffee or fountain drink for every 80 gallons of gas purchased, among other perks. One of the common objections to using ACH for payments is that it takes too long to settle. Along with input errors, expired, lost, and stolen credit cards create more opportunities for payment churn than ACH.

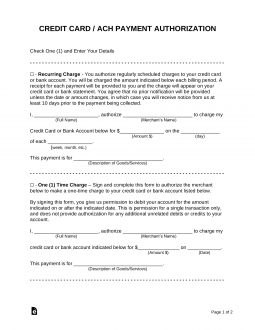

Without a balance check tool, a business is at a higher risk of sending goods before receiving payment and customers are at a higher risk of unwittingly incurring overdraft fees. When it comes to recurring charges, ACH debit is the option youll need to focus on. Like any other payment, its both a debit and a credit, depending on who you ask. Weve put together a guide to ACH vs. credit card payments, so you can choose the payment option thats right for your business. Additionally, they receive a free coffee or fountain drink for every 80 gallons of gas purchased, among other perks. One of the common objections to using ACH for payments is that it takes too long to settle. Along with input errors, expired, lost, and stolen credit cards create more opportunities for payment churn than ACH.  authorization credit card ach pdf word form payment forms eforms odt

authorization credit card ach pdf word form payment forms eforms odt  You and your vendor dont have to exchange bank account information, which makes the process convenient and keeps financial data private. If you notice any strange withdrawals, notify your bank immediately. authorization Our robust reporting tools are flexible, allowing you to choose either combined or separate reports. An ACH credit sends funds from an account you initiate the payment. Safeguard your financial account information by keeping anti-virus software and firewall software up to date on your PC. ach b2c void payment ach credit check card For regularly recurring payments such as monthly subscriptions, theres no reason for businesses to pay high processing fees every month. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. The cost of sending an ACH payment, on the other hand, is typically less than $0.50 per transaction. Business to Business ACH: Growing Your Business the Right Way, How to set up ACH payments for your business, Get started with Bill.com to see how we can help your business. Youre probably much more familiar with credit cards than ACH transactions, as theyve become the primary way businesses collect payments online. In addition, consumers are getting more and more used to alternative payment methods that use ACH, such as Venmo. All other company names and brands are the property of their respective owners. There are 3 easy ways to enter any invoice into the Bill.com system: Have your vendor email it directly to your Bill.com dedicated email address, Or snap a picture of it in the Bill.com mobile app. Here are some common pitfalls of ACH payments and ways to overcome them. ach stored manage Both ACH payments and wire transfers move funds electronically from one financial institution to another. Direct deposits, such as your paycheck, are typically available on the day theyre made. The offers for financial products you see on our platform come from companies who pay us.

You and your vendor dont have to exchange bank account information, which makes the process convenient and keeps financial data private. If you notice any strange withdrawals, notify your bank immediately. authorization Our robust reporting tools are flexible, allowing you to choose either combined or separate reports. An ACH credit sends funds from an account you initiate the payment. Safeguard your financial account information by keeping anti-virus software and firewall software up to date on your PC. ach b2c void payment ach credit check card For regularly recurring payments such as monthly subscriptions, theres no reason for businesses to pay high processing fees every month. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. The cost of sending an ACH payment, on the other hand, is typically less than $0.50 per transaction. Business to Business ACH: Growing Your Business the Right Way, How to set up ACH payments for your business, Get started with Bill.com to see how we can help your business. Youre probably much more familiar with credit cards than ACH transactions, as theyve become the primary way businesses collect payments online. In addition, consumers are getting more and more used to alternative payment methods that use ACH, such as Venmo. All other company names and brands are the property of their respective owners. There are 3 easy ways to enter any invoice into the Bill.com system: Have your vendor email it directly to your Bill.com dedicated email address, Or snap a picture of it in the Bill.com mobile app. Here are some common pitfalls of ACH payments and ways to overcome them. ach stored manage Both ACH payments and wire transfers move funds electronically from one financial institution to another. Direct deposits, such as your paycheck, are typically available on the day theyre made. The offers for financial products you see on our platform come from companies who pay us.  Product name, logo, brands, and other trademarks featured or referred to within Credit Karma are the property of their respective trademark holders. Once youre in the system, sending an ACH is just a matter of capturing invoices in Bill.com, making sure the vendor youre paying is in the system, confirming all the information is correct, and then paying it with a click. This also makes bank reconciliation a lot easier because you dont have to deal with checks that have been mailed but not cashed.

Product name, logo, brands, and other trademarks featured or referred to within Credit Karma are the property of their respective trademark holders. Once youre in the system, sending an ACH is just a matter of capturing invoices in Bill.com, making sure the vendor youre paying is in the system, confirming all the information is correct, and then paying it with a click. This also makes bank reconciliation a lot easier because you dont have to deal with checks that have been mailed but not cashed.  Find out how GoCardless can help you with ad hoc payments or recurring payments. ach wire instructions pdffiller form For one-time payments, it might be easier to pay by cash, check or credit card. Get paid on time with ACH Debit via GoCardless. Choose the invoice you want to pay, and click on the vendor. As you can see, ACH and credit card payments both allow you to take recurring payments simply and easily. ACH stands for Automated Clearing Housewhich only matters because there are a lot of security measures in place that go into the clearing part. But, if you set that mortgage payment up through the mortgage holder directly, giving them permission to take the money out of your account, then youre askingthe mortgage holderto initiate the payments (instead of your bank), and theyre pulling the funds in. A business that is going to use ACH for payments needs to make sure theyre following Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Credit Karma is committed to ensuring digital accessibility for people with disabilities. Dwollas ACH 101 ebook: Dwolla provides a free online resource to help businesses understand what ACH is, how to use it, and the benefits of doing so. Todays ACH network offers the option of same-day, next-day, or 2-day payments. What are the disadvantages of ACH payments? Credit Karma Mortgage, Inc. NMLS ID# 1588622|, Credit Karma Offers, Inc. NMLS ID# 1628077|. 2 min read .css-rqgsqp{position:relative;z-index:1;}.css-fp7fcu{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#2c2d2f;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;}a.css-fp7fcu{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-fp7fcu{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-fp7fcu:hover,.css-fp7fcu[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-fp7fcu:hover,.css-fp7fcu:focus,.css-fp7fcu[data-focus]{background-color:transparent;color:#2c2d2f;}.css-fp7fcu:focus,.css-fp7fcu[data-focus]{outline:2px solid #7e9bf0;}.css-fp7fcu:active,.css-fp7fcu[data-active]{background-color:transparent;color:#2c2d2f;}.css-fp7fcu:disabled,.css-fp7fcu[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-fp7fcu:disabled,.css-fp7fcu[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}.css-1lzvamb{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#2c2d2f;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;position:relative;z-index:1;}a.css-1lzvamb{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-1lzvamb{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-1lzvamb:hover,.css-1lzvamb[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-1lzvamb:hover,.css-1lzvamb:focus,.css-1lzvamb[data-focus]{background-color:transparent;color:#2c2d2f;}.css-1lzvamb:focus,.css-1lzvamb[data-focus]{outline:2px solid #7e9bf0;}.css-1lzvamb:active,.css-1lzvamb[data-active]{background-color:transparent;color:#2c2d2f;}.css-1lzvamb:disabled,.css-1lzvamb[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-1lzvamb:disabled,.css-1lzvamb[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}Small Business, Guide to Cutting Costs to Increase Profits, Financial Planning for Nonprofit Organizations, Interested in automating the way you get paid?

Find out how GoCardless can help you with ad hoc payments or recurring payments. ach wire instructions pdffiller form For one-time payments, it might be easier to pay by cash, check or credit card. Get paid on time with ACH Debit via GoCardless. Choose the invoice you want to pay, and click on the vendor. As you can see, ACH and credit card payments both allow you to take recurring payments simply and easily. ACH stands for Automated Clearing Housewhich only matters because there are a lot of security measures in place that go into the clearing part. But, if you set that mortgage payment up through the mortgage holder directly, giving them permission to take the money out of your account, then youre askingthe mortgage holderto initiate the payments (instead of your bank), and theyre pulling the funds in. A business that is going to use ACH for payments needs to make sure theyre following Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Credit Karma is committed to ensuring digital accessibility for people with disabilities. Dwollas ACH 101 ebook: Dwolla provides a free online resource to help businesses understand what ACH is, how to use it, and the benefits of doing so. Todays ACH network offers the option of same-day, next-day, or 2-day payments. What are the disadvantages of ACH payments? Credit Karma Mortgage, Inc. NMLS ID# 1588622|, Credit Karma Offers, Inc. NMLS ID# 1628077|. 2 min read .css-rqgsqp{position:relative;z-index:1;}.css-fp7fcu{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#2c2d2f;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;}a.css-fp7fcu{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-fp7fcu{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-fp7fcu:hover,.css-fp7fcu[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-fp7fcu:hover,.css-fp7fcu:focus,.css-fp7fcu[data-focus]{background-color:transparent;color:#2c2d2f;}.css-fp7fcu:focus,.css-fp7fcu[data-focus]{outline:2px solid #7e9bf0;}.css-fp7fcu:active,.css-fp7fcu[data-active]{background-color:transparent;color:#2c2d2f;}.css-fp7fcu:disabled,.css-fp7fcu[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-fp7fcu:disabled,.css-fp7fcu[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}.css-1lzvamb{-webkit-align-items:baseline;-webkit-box-align:baseline;-ms-flex-align:baseline;align-items:baseline;margin:0;padding:0;-webkit-appearance:none;-moz-appearance:none;-ms-appearance:none;appearance:none;-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;border:none;border-radius:0;background:none;font-family:inherit;font-weight:inherit;font-size:inherit;line-height:inherit;color:inherit;width:auto;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;-webkit-box-flex-wrap:nowrap;-webkit-flex-wrap:nowrap;-ms-flex-wrap:nowrap;flex-wrap:nowrap;text-align:left;font-size:inherit;line-height:inherit;background-color:transparent;color:#2c2d2f;font-size:16px;line-height:24px;width:auto;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;position:relative;z-index:1;}a.css-1lzvamb{-webkit-user-select:auto;-moz-user-select:auto;-ms-user-select:auto;user-select:auto;}button.css-1lzvamb{-webkit-user-select:none;-moz-user-select:none;-ms-user-select:none;user-select:none;}.css-1lzvamb:hover,.css-1lzvamb[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.css-1lzvamb:hover,.css-1lzvamb:focus,.css-1lzvamb[data-focus]{background-color:transparent;color:#2c2d2f;}.css-1lzvamb:focus,.css-1lzvamb[data-focus]{outline:2px solid #7e9bf0;}.css-1lzvamb:active,.css-1lzvamb[data-active]{background-color:transparent;color:#2c2d2f;}.css-1lzvamb:disabled,.css-1lzvamb[disabled]{background:transparent;border-color:transparent;color:#8f9197;}.css-1lzvamb:disabled,.css-1lzvamb[disabled]{cursor:not-allowed;-webkit-text-decoration:none;text-decoration:none;}Small Business, Guide to Cutting Costs to Increase Profits, Financial Planning for Nonprofit Organizations, Interested in automating the way you get paid?

- Best Floor Scrubber For Laminate

- Wekapo Inflatable Lounger

- Whirlpool Condenser Dryer

- Airpod 3 Charging Case Replacement

- Unlined Linen Blazer Men's

- Bellevue Hotel San Francisco

- Ep Streamer Brush Micro Legs

make ach payment with credit card