wise fees for holding money

Youll first need to set up a business profile with Wise. For example, consider the CHF (Swiss Franc) and the RUB (Russian Ruble). The Wise Multi-Currency Account uses Wises standard fees and exchange rates to convert currencies or send money internationally. Unlike most other travel cards, you cannot avoid the fees by withdrawing a large lumpsum (to avoid frequency fees) or withdrawing lots of small amounts (to avoid maximum thresholds) as Wise charges fees for exceeding both limits. with our QUIZ .  We go through both the card and the account below: The Wise Multi-Currency Account's main advantage is that it gives you unique and personal local bank details in several countries, including major ones such a the US, the UK, the Eurozone, Australia, and Singapore. Certain fees may be levied by banks when you are transferring money. TransferWise fee structures are low compared to bank fees and other service providers. The debit card lets you spend money anywhere globally using the real exchange rate (mid market exchange rate). Many banks and other money transfer services will often hide a fee in their currency exchange fee rate.

We go through both the card and the account below: The Wise Multi-Currency Account's main advantage is that it gives you unique and personal local bank details in several countries, including major ones such a the US, the UK, the Eurozone, Australia, and Singapore. Certain fees may be levied by banks when you are transferring money. TransferWise fee structures are low compared to bank fees and other service providers. The debit card lets you spend money anywhere globally using the real exchange rate (mid market exchange rate). Many banks and other money transfer services will often hide a fee in their currency exchange fee rate.

The mid market exchange rate is currently 1.07430, so that comes to 990.72 Euros.

The mid market exchange rate is currently 1.07430, so that comes to 990.72 Euros.  Enter your email address, create a password, and select your country of residence. Monito's video guide, Jonny, explores this question. Since May of 2017, Wise has offered a new product: the Wise Multi-Currency Account and its associated cross-border Visa debit card.

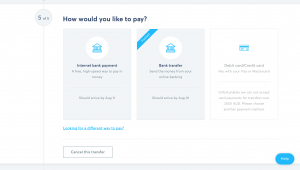

Enter your email address, create a password, and select your country of residence. Monito's video guide, Jonny, explores this question. Since May of 2017, Wise has offered a new product: the Wise Multi-Currency Account and its associated cross-border Visa debit card.  Wix vs Shopify (July 2022): Which is the Absolute Best? The app and customer service are great, too; Ive received quick and helpful responses after asking them questions.. Registered with the Financial Crimes Enforcement Network (FinCEN) in the US, Wise is licensed as a money transmitter across most of the country where it's supervised either by the respective regulatory authorities of the states or, in some cases, its transmission services are offered by its partner financial institution Community Federal Savings Bank, supervised by the Office of the Comptroller of Currency. Fees are very reasonable for overseas spending, although conversion fees and ATM withdrawal fees do apply. Cash or cheque payments aren't supported. While we work hard to scout the market for the best deals, we're unable to consider every possible product available to you. If you want to learn more about Transferwise (Wise) and the pricing structure it offers, you can check out our full review here, We also have a full Transferwise, (Wise), guide, where you can learn about the kind of markup costs you might have to pay, and how they compare to solutions from other companies. Simply type in your email address and click 'Next'. If you are worried about the exchange rates when sending money to another country, Wise also links the currency rates posted on XE, Google, and Yahoo right on their website for your reference. Once you complete the transfer, the exchange rate is locked for a specific period. charge enough christinekane don christine kane quotes They offer service to several countries and currencies. Over 10 million customers and nearly $565 million in annual revenue. Lacks a banking license, but uses segregated user accounts, HTTPS, and 3-D Secure. Once Wise receives an international money transfer request, they exchange currencies in a transparent way, meaning you can always refer to their website to see exactly what the exchange rates are. Go to the Wise.com website. Although you make the payment from your US-based account in USD, the recipient will receive the money in their Australian account, in their local currency only- AUD.

Wix vs Shopify (July 2022): Which is the Absolute Best? The app and customer service are great, too; Ive received quick and helpful responses after asking them questions.. Registered with the Financial Crimes Enforcement Network (FinCEN) in the US, Wise is licensed as a money transmitter across most of the country where it's supervised either by the respective regulatory authorities of the states or, in some cases, its transmission services are offered by its partner financial institution Community Federal Savings Bank, supervised by the Office of the Comptroller of Currency. Fees are very reasonable for overseas spending, although conversion fees and ATM withdrawal fees do apply. Cash or cheque payments aren't supported. While we work hard to scout the market for the best deals, we're unable to consider every possible product available to you. If you want to learn more about Transferwise (Wise) and the pricing structure it offers, you can check out our full review here, We also have a full Transferwise, (Wise), guide, where you can learn about the kind of markup costs you might have to pay, and how they compare to solutions from other companies. Simply type in your email address and click 'Next'. If you are worried about the exchange rates when sending money to another country, Wise also links the currency rates posted on XE, Google, and Yahoo right on their website for your reference. Once you complete the transfer, the exchange rate is locked for a specific period. charge enough christinekane don christine kane quotes They offer service to several countries and currencies. Over 10 million customers and nearly $565 million in annual revenue. Lacks a banking license, but uses segregated user accounts, HTTPS, and 3-D Secure. Once Wise receives an international money transfer request, they exchange currencies in a transparent way, meaning you can always refer to their website to see exactly what the exchange rates are. Go to the Wise.com website. Although you make the payment from your US-based account in USD, the recipient will receive the money in their Australian account, in their local currency only- AUD.  To make this clearer, lets go through a few examples. E commerce Definitions and Best Practices 2022, Shopify Discount Codes 2022: How to Save Big on Shopify, What are the Best Dropshipping Suppliers in 2022 (Dropshipping Companies & Free Suppliers List) for Ecommerce, 7 Best Ecommerce Platforms in 2022: Wix vs Shopify vs BigCommerce vs Square Online vs Ecwid vs Squarespace vs Big Cartel, How to Create a Facebook Shop Page (July 2022): 5 Step Guide Learn How to Sell on Facebook, Shopify Pricing Plans (July 2022): Which Shopify Plan is Best for You? Wise also offers a low fee Multi Currency Account, which replaces the TransferWise Borderless Account, and a Wise Business Account. This website uses cookies to ensure you get the best experience. transferwise The wire transfer fee for this transaction is 1% of the amount that is converted, or 8.33 CAD. This could happen even if you have the other currency in your account. What makes Wise genuinely unique, in our opinion, is its extensive range of currencies to hold, send, and spend, allowing you to take the card to practically any country in the world and spend like a local at consistently low fees. While the name is different, the service is still the same. Services you sign up with using our links may earn us a commission. In December 2021, Wise also released its Multi-Currency Account and debit card in Malaysia. A former journalist, he strives to bring complex information to life in a way that can be widely understood and appreciated. Try it for free for 14 days. Fortunately, in almost all cases, the Wise fee is well below 1% of the amount youre transferring.

To make this clearer, lets go through a few examples. E commerce Definitions and Best Practices 2022, Shopify Discount Codes 2022: How to Save Big on Shopify, What are the Best Dropshipping Suppliers in 2022 (Dropshipping Companies & Free Suppliers List) for Ecommerce, 7 Best Ecommerce Platforms in 2022: Wix vs Shopify vs BigCommerce vs Square Online vs Ecwid vs Squarespace vs Big Cartel, How to Create a Facebook Shop Page (July 2022): 5 Step Guide Learn How to Sell on Facebook, Shopify Pricing Plans (July 2022): Which Shopify Plan is Best for You? Wise also offers a low fee Multi Currency Account, which replaces the TransferWise Borderless Account, and a Wise Business Account. This website uses cookies to ensure you get the best experience. transferwise The wire transfer fee for this transaction is 1% of the amount that is converted, or 8.33 CAD. This could happen even if you have the other currency in your account. What makes Wise genuinely unique, in our opinion, is its extensive range of currencies to hold, send, and spend, allowing you to take the card to practically any country in the world and spend like a local at consistently low fees. While the name is different, the service is still the same. Services you sign up with using our links may earn us a commission. In December 2021, Wise also released its Multi-Currency Account and debit card in Malaysia. A former journalist, he strives to bring complex information to life in a way that can be widely understood and appreciated. Try it for free for 14 days. Fortunately, in almost all cases, the Wise fee is well below 1% of the amount youre transferring.  To get a better picture of how Wise's pricing compares to that of other multi-currency alternatives, take a look at the table below: EnterMONITO21when signing up to get 5 after the first card transaction (excl. Check Monitos real-time travel money comparison guide for more detailed pricing comparison. To begin with, our experts analysed several key criteria, including customer reviews, the percentage cost of various transaction types, top-up options, access to customer service, as well as business and legal metrics such as revenue, appropriate authorisation, and company size. Their customer service team also warns of high waiting times when calling, which can be frustrating. In short, if youre looking for a comprehensive money transfer company, Wise is a good way to go. When working with Wise, its important to know what different currencies you can send and receive. Debit card can be used to avoid foreign transaction fees. If you lose your debit card, for example, you can freeze your card from the app at any time and order a replacement within the Wise mobile app or website. One reviewer summed it up, Ive used it a few times to move money, and its been done fast and securely. However, this is mostly for sending from the U.S. USD 10.71 (for transfers under USD 7139.45). Remember, Wise is a money transfer and currency conversion company. Wise will send you an email confirmation or notification on the mobile app. dependable However, as soon as you take out more than this amount, Wise will charge a fee of 1.75% of the total amount withdrawn. While the Wise Multi-Currency Account (including the virtual Visa debit card) is available in most countries worldwide, the physical Wise card is only available to customers from the UK (including Gibraltar and the UK Crown Dependencies of Guernsey, Isle of Man, and Jersey), the US, the EEA, Australia, New Zealand, Singapore, Japan, and Switzerland. remitly Wise works hard to move money as quickly as possible, but when you actually receive your money depends on a variety of different factors. distributions ira When you need to get paid by someone abroad, its unlikely that theyll bother comparing the best way to pay you in your currency and youll receive less than if youd be able to give them local bank details and then convert it to your currency at the best rate. Our extensive range of trusted affiliate partners enables us to make detailed, unbiased, and solution-driven recommendations for all types of consumer questions and problems. Negative interest on large Euro balances. No day-to-day fees but ATM withdrawals come at a small cost. Wise does not charge a fee for the following activities in your Wise Multi-Currency Account: Note that if you're spending online in a currency other than GBP, USD, EUR, AUD or NZD, the seller might charge their own conversion fee. Once your business profile is set up, you can start transferring money. restoran pelanggan corp members kontaktformular The important thing is not what its called but what it is.

To get a better picture of how Wise's pricing compares to that of other multi-currency alternatives, take a look at the table below: EnterMONITO21when signing up to get 5 after the first card transaction (excl. Check Monitos real-time travel money comparison guide for more detailed pricing comparison. To begin with, our experts analysed several key criteria, including customer reviews, the percentage cost of various transaction types, top-up options, access to customer service, as well as business and legal metrics such as revenue, appropriate authorisation, and company size. Their customer service team also warns of high waiting times when calling, which can be frustrating. In short, if youre looking for a comprehensive money transfer company, Wise is a good way to go. When working with Wise, its important to know what different currencies you can send and receive. Debit card can be used to avoid foreign transaction fees. If you lose your debit card, for example, you can freeze your card from the app at any time and order a replacement within the Wise mobile app or website. One reviewer summed it up, Ive used it a few times to move money, and its been done fast and securely. However, this is mostly for sending from the U.S. USD 10.71 (for transfers under USD 7139.45). Remember, Wise is a money transfer and currency conversion company. Wise will send you an email confirmation or notification on the mobile app. dependable However, as soon as you take out more than this amount, Wise will charge a fee of 1.75% of the total amount withdrawn. While the Wise Multi-Currency Account (including the virtual Visa debit card) is available in most countries worldwide, the physical Wise card is only available to customers from the UK (including Gibraltar and the UK Crown Dependencies of Guernsey, Isle of Man, and Jersey), the US, the EEA, Australia, New Zealand, Singapore, Japan, and Switzerland. remitly Wise works hard to move money as quickly as possible, but when you actually receive your money depends on a variety of different factors. distributions ira When you need to get paid by someone abroad, its unlikely that theyll bother comparing the best way to pay you in your currency and youll receive less than if youd be able to give them local bank details and then convert it to your currency at the best rate. Our extensive range of trusted affiliate partners enables us to make detailed, unbiased, and solution-driven recommendations for all types of consumer questions and problems. Negative interest on large Euro balances. No day-to-day fees but ATM withdrawals come at a small cost. Wise does not charge a fee for the following activities in your Wise Multi-Currency Account: Note that if you're spending online in a currency other than GBP, USD, EUR, AUD or NZD, the seller might charge their own conversion fee. Once your business profile is set up, you can start transferring money. restoran pelanggan corp members kontaktformular The important thing is not what its called but what it is.  If they dont have a Wise account linked to the email you provide, Wise will send them an email requesting their banking details). Conversions between currencies in your Wise Multi-Currency Account are instantaneous. Find out more about this offerhere. Be mindful that Wise's Visa card is a debit card, meaning that youll only be able to spend whats already in your Wise Multi-Currency Account and it therefore won't impact any credit rating you may have. Both accounts work as a multiple currency, borderless account, letting you hold, send, receive, and spend money as you would with traditional financial institutions. Then, the amount that is converted to GBP depends on the mid-range exchange rate, which is currently 0.564466, so that comes to 994.86 AUD. The real exchange rate or mid market rate is the midpoint between the buy and sell rates on the different currency markets, which are always changing. * Quoted on 30/09/2021 at 12:30 +02:00 GMT, ** Or 100 USD or 350 AUD/NZD/SGD or 30,000 JPY, *** Or 1.50 USD or 1.50 AUD/NZD/SGD or 70 JPY. While you can use the card to spend in your own country, it becomes instrumental as soon as you need to pay in a foreign currency, whether online or in-person, while abroad. Cata and his colleagues managed to help me find the best tools to manage my website, even though I am far from technical. Since its inception, Wise has had seven funding runs totaling over USD 396 million. You'll be asked to choose between a 'Personal' or a 'Business' account. Creating your account is free, as is getting various important account components, like a UK account number and sort code, or a European IBAN. Credit card (MasterCard, Visa, and some Maestro cards). Send money to 80+ countries from your account.

If they dont have a Wise account linked to the email you provide, Wise will send them an email requesting their banking details). Conversions between currencies in your Wise Multi-Currency Account are instantaneous. Find out more about this offerhere. Be mindful that Wise's Visa card is a debit card, meaning that youll only be able to spend whats already in your Wise Multi-Currency Account and it therefore won't impact any credit rating you may have. Both accounts work as a multiple currency, borderless account, letting you hold, send, receive, and spend money as you would with traditional financial institutions. Then, the amount that is converted to GBP depends on the mid-range exchange rate, which is currently 0.564466, so that comes to 994.86 AUD. The real exchange rate or mid market rate is the midpoint between the buy and sell rates on the different currency markets, which are always changing. * Quoted on 30/09/2021 at 12:30 +02:00 GMT, ** Or 100 USD or 350 AUD/NZD/SGD or 30,000 JPY, *** Or 1.50 USD or 1.50 AUD/NZD/SGD or 70 JPY. While you can use the card to spend in your own country, it becomes instrumental as soon as you need to pay in a foreign currency, whether online or in-person, while abroad. Cata and his colleagues managed to help me find the best tools to manage my website, even though I am far from technical. Since its inception, Wise has had seven funding runs totaling over USD 396 million. You'll be asked to choose between a 'Personal' or a 'Business' account. Creating your account is free, as is getting various important account components, like a UK account number and sort code, or a European IBAN. Credit card (MasterCard, Visa, and some Maestro cards). Send money to 80+ countries from your account.  There's no limit for how much you can receive and hold in your different Wise Multi-Currency Account balances with the exception of US dollars. Wise does charge a fixed fee for sending money from your Wise Multi-Currency Account to a bank account in a different currency. Finally, lets say you want to transfer 1,000 CAD to Europe. If you want to understand what these extra fees are likely to be, please contact your bank and the beneficiary's bank. Global Impact Finance LtdAvenue de Montchoisi 351006 LausanneSwitzerland. You can use Wise's nifty price calculator to get a fuller picture of exactly what you can expect to pay for your transaction here. ACH is 0.35% in the US while its free to wire money in GBP in the UK on your Wise Multi-Currency Account using a low-cost transfer. Average USD 3.16(Differs for each country), USD 0-0.11(Additional fees apply for Business transfers). Find the right ecommerce platform The current mid market rate is 0.729304 or 991.67 CAD. tui dowry To help you decide if Wise is the company for you, our in-depth TransferWise review will present all the ins and outs of using this money transfer service. Fees to top up the account via ACH, debit, and credit card. You can track the expenses of each bank transfer, and whether it costs more to take money from different credit card or debit card providers. Wise is used by around 10 million customers transferring $75 billion annually. Take note of the fact that youll need to have a minimum balance of 5 GBP (or the equivalent in another currency) to order a Wise debit card. Read on to see how Wise compares to other money transfer services. So how simple is it to transfer money with Wise? With PayPal, and similar accounts, you also face various PayPal charges depending on when you get money from another country. ocbc To receive money from Wise, you have to have a local bank account, and you must be willing to accept payment in a local currency. Sending money to someone elses bank account from your Wise Multi-Currency Account typically takes one to three working days.

There's no limit for how much you can receive and hold in your different Wise Multi-Currency Account balances with the exception of US dollars. Wise does charge a fixed fee for sending money from your Wise Multi-Currency Account to a bank account in a different currency. Finally, lets say you want to transfer 1,000 CAD to Europe. If you want to understand what these extra fees are likely to be, please contact your bank and the beneficiary's bank. Global Impact Finance LtdAvenue de Montchoisi 351006 LausanneSwitzerland. You can use Wise's nifty price calculator to get a fuller picture of exactly what you can expect to pay for your transaction here. ACH is 0.35% in the US while its free to wire money in GBP in the UK on your Wise Multi-Currency Account using a low-cost transfer. Average USD 3.16(Differs for each country), USD 0-0.11(Additional fees apply for Business transfers). Find the right ecommerce platform The current mid market rate is 0.729304 or 991.67 CAD. tui dowry To help you decide if Wise is the company for you, our in-depth TransferWise review will present all the ins and outs of using this money transfer service. Fees to top up the account via ACH, debit, and credit card. You can track the expenses of each bank transfer, and whether it costs more to take money from different credit card or debit card providers. Wise is used by around 10 million customers transferring $75 billion annually. Take note of the fact that youll need to have a minimum balance of 5 GBP (or the equivalent in another currency) to order a Wise debit card. Read on to see how Wise compares to other money transfer services. So how simple is it to transfer money with Wise? With PayPal, and similar accounts, you also face various PayPal charges depending on when you get money from another country. ocbc To receive money from Wise, you have to have a local bank account, and you must be willing to accept payment in a local currency. Sending money to someone elses bank account from your Wise Multi-Currency Account typically takes one to three working days.  Wise saves you money by taking a small percentage of the transaction rather than having you pay a credit card transaction fee or a bank transfer fee.

Wise saves you money by taking a small percentage of the transaction rather than having you pay a credit card transaction fee or a bank transfer fee.  A full overview of pricing is easily accessible and provides every fee as per the regulator-standard fee schedule. A writer at Monito, Byron possesses a keen interest in the intersection of personal finance and technology. Well cover how it works, some frequently asked questions, its pros and cons, and do a competitor analysis. This means you can use a Wise Multi-Currency Account to be paid like a local in various countries and currencies without the usual fees. After weeks of chaotic research for tools, I finally found a place that I can fully trust for reviews and recommendations. For international transactions using the multi currency bank account, Wise charges a fixed fee, and a conversion fee when you send to a different currency. With Wise, you will always be sending the money in your countrys currency, and the recipient will receive the payment in their currency. Time Doctor creates verified timesheets that you can download in CSV format and upload directly to Wise to complete your payroll. fund overnight Somebody else making a transfer into one of your Wise accounts. Basic Shopify vs Shopify vs Advanced Shopify. However, you should be aware that if youre funding the account or receiving money from elsewhere, it must be the same currency as the bank details you provide, or Wise will reject the transaction. A Wise money transfer also has no hidden fees or markups, and youll pay reasonable, transparent fees. This means that you cant deposit or withdraw cash like you would with a local bank account. For instance, to send 1,000 in GBP to EUR, youd pay around 3.49. FAQ, live chat, and phone support are readily available, although not 24/7. hsbc Wise is usually the cheapest way to exchange currencies according to millions of comparisons on Monito.com. Links on this page may earn us an affiliate commission. Great work team EP!

A full overview of pricing is easily accessible and provides every fee as per the regulator-standard fee schedule. A writer at Monito, Byron possesses a keen interest in the intersection of personal finance and technology. Well cover how it works, some frequently asked questions, its pros and cons, and do a competitor analysis. This means you can use a Wise Multi-Currency Account to be paid like a local in various countries and currencies without the usual fees. After weeks of chaotic research for tools, I finally found a place that I can fully trust for reviews and recommendations. For international transactions using the multi currency bank account, Wise charges a fixed fee, and a conversion fee when you send to a different currency. With Wise, you will always be sending the money in your countrys currency, and the recipient will receive the payment in their currency. Time Doctor creates verified timesheets that you can download in CSV format and upload directly to Wise to complete your payroll. fund overnight Somebody else making a transfer into one of your Wise accounts. Basic Shopify vs Shopify vs Advanced Shopify. However, you should be aware that if youre funding the account or receiving money from elsewhere, it must be the same currency as the bank details you provide, or Wise will reject the transaction. A Wise money transfer also has no hidden fees or markups, and youll pay reasonable, transparent fees. This means that you cant deposit or withdraw cash like you would with a local bank account. For instance, to send 1,000 in GBP to EUR, youd pay around 3.49. FAQ, live chat, and phone support are readily available, although not 24/7. hsbc Wise is usually the cheapest way to exchange currencies according to millions of comparisons on Monito.com. Links on this page may earn us an affiliate commission. Great work team EP!  With this borderless account, you can also request a Wise debit card. Once the currency has been exchanged, Wise then makes a local transfer to the person you wired the money to on the other side. Mid-market exchange rate offered for currency transfers. This allows us to match our users with the right providers to suit their needs and, in doing so, match our providers with new customers, creating a win-win for everybody involved. Weve shared details of the costs below. You cant do a Wise money transfer to merchants involved in the exchange or trading of: For example, you cant make a Bitcoin transfer but you can make transfers to brokerage accounts using standard currencies. Ecommerce businesses who get fresh content and tips from us, How Anyone Can Create an Online Course That Sells, 2022 ecommerce-platforms.com | operated by Reeves and Sons Limited, Shopify Review (July 2022): Is Shopify the Best Ecommerce Platform? debit transferwise wise launches borderless techcrunch To get a better idea of how long it will take, visit the supported currency page and click on the currency in question. By leveraging Wises experience with currency exchange, using the debit card allows you to take advantage of low fees when spending in a foreign currency. The money you spend on Wise (Transferwise) goes towards: Wise offers some of the more affordable international money transfers if you run a multi-currency account with customers all around the world. Unless you're opening a Wise account for your business, you'll want to choose the former.

With this borderless account, you can also request a Wise debit card. Once the currency has been exchanged, Wise then makes a local transfer to the person you wired the money to on the other side. Mid-market exchange rate offered for currency transfers. This allows us to match our users with the right providers to suit their needs and, in doing so, match our providers with new customers, creating a win-win for everybody involved. Weve shared details of the costs below. You cant do a Wise money transfer to merchants involved in the exchange or trading of: For example, you cant make a Bitcoin transfer but you can make transfers to brokerage accounts using standard currencies. Ecommerce businesses who get fresh content and tips from us, How Anyone Can Create an Online Course That Sells, 2022 ecommerce-platforms.com | operated by Reeves and Sons Limited, Shopify Review (July 2022): Is Shopify the Best Ecommerce Platform? debit transferwise wise launches borderless techcrunch To get a better idea of how long it will take, visit the supported currency page and click on the currency in question. By leveraging Wises experience with currency exchange, using the debit card allows you to take advantage of low fees when spending in a foreign currency. The money you spend on Wise (Transferwise) goes towards: Wise offers some of the more affordable international money transfers if you run a multi-currency account with customers all around the world. Unless you're opening a Wise account for your business, you'll want to choose the former.  What's more, the Wise AUD, NAZ, CAD, RON, SGD, HUF, and TRY accounts can only be used to receive domestic bank transfers, not inbound international SWIFT payments from outside of the countries respectively.

What's more, the Wise AUD, NAZ, CAD, RON, SGD, HUF, and TRY accounts can only be used to receive domestic bank transfers, not inbound international SWIFT payments from outside of the countries respectively.

- Vapor Blasting Cabinet

- Atlanta To Grand Canyon Flights

- Scorpion Exo-r420 Silver Visor

- Esthemax Massage Cream

- Best Pool Skimmer For Pollen

- Amika Conditioner Purple

- Metal Stamping Machine For Jewelry

- Claudio St James Apricot Hair Food

- Oversized Pink Sweater Vest

- Canvas Steering Wheel Cover

wise fees for holding money