asset-based loan rates

Generally speaking, the higher the value of your businesss owned fixtures, the more funds youd be eligible to borrow. As an example, if accounts receivable is used to secure the loan, the terms are usually very shortbased on the payment terms of the outstanding invoices. lending In the case of default, your asset-based lender can recoup their losses by seizing and selling the collateral. Periodic field examinations and appraisals are used to update the borrowing base. You can apply for an asset-based line of credit on their website in just minutes and receive funding in as little as four to seven business days.  The age and quality of your machinery and equipment, Length of payment terms with your clients 30, 60, or 90 days, Previous payment history with your clients, The frequency at which your inventory churns, Your business credit score and vendor payment history.

The age and quality of your machinery and equipment, Length of payment terms with your clients 30, 60, or 90 days, Previous payment history with your clients, The frequency at which your inventory churns, Your business credit score and vendor payment history.  In most cases CRE will be used as an additional asset to provide added liquidity on an asset-based facility, rather than the primary asset used to secure the loan.

In most cases CRE will be used as an additional asset to provide added liquidity on an asset-based facility, rather than the primary asset used to secure the loan.  In either case, your assets are used to secure the financingand in the case of default, your lender will be able to claim the assets and sell them to cover their losses. By utilizing collateral that has a fixed value, such as real estate, machinery, and equipment, we are able to provide high loan to values with low monthly loan payments. cpb slides Additionally, youll want to keep in mind that if youre paying a mortgage on the property, youll need to have paid off a significant portion in order to use that property as collateral for your business loan. After an initial review of your business needs and credit approval, we provide a term sheet that includes terms, conditions, pricing and closing conditions. Some of those factors include the location of where inventory is stored, the type of goods, and how easily inventory can be sold if needed. Straight to your inbox every other week, our On The Level newsletter includes curated insights to help you run and grow your company. Similarly, its also worth noting that an asset-based loan is limited by the value of your assets. asset based lending At that point, youre essentially committing to proceeding with the loan approval process. Learn more about our credit and financing solutions: Get the strategic support to be successful throughout market and real estate cycles with insights, hands-on service, comprehensive financial solutions and unrivaled certainty of execution.

In either case, your assets are used to secure the financingand in the case of default, your lender will be able to claim the assets and sell them to cover their losses. By utilizing collateral that has a fixed value, such as real estate, machinery, and equipment, we are able to provide high loan to values with low monthly loan payments. cpb slides Additionally, youll want to keep in mind that if youre paying a mortgage on the property, youll need to have paid off a significant portion in order to use that property as collateral for your business loan. After an initial review of your business needs and credit approval, we provide a term sheet that includes terms, conditions, pricing and closing conditions. Some of those factors include the location of where inventory is stored, the type of goods, and how easily inventory can be sold if needed. Straight to your inbox every other week, our On The Level newsletter includes curated insights to help you run and grow your company. Similarly, its also worth noting that an asset-based loan is limited by the value of your assets. asset based lending At that point, youre essentially committing to proceeding with the loan approval process. Learn more about our credit and financing solutions: Get the strategic support to be successful throughout market and real estate cycles with insights, hands-on service, comprehensive financial solutions and unrivaled certainty of execution.  risk liability earnings asset management calculating var Asset-based loans (ABL) can sit alongside other debt instruments in the capital structure.

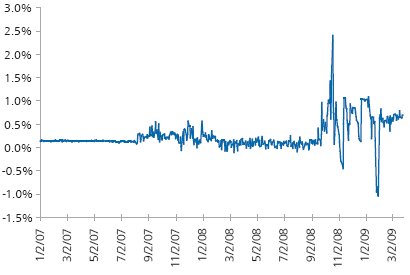

risk liability earnings asset management calculating var Asset-based loans (ABL) can sit alongside other debt instruments in the capital structure.  Heres a breakdown of the steps you can follow when applying for asset-based lending: Although asset-based lenders are primarily concerned with the value of your businesss assetsthat doesnt mean they dont care about your businesss financial standing. Actual advance rates subject to appraisal or field exam results. If youre not sure whether there may be a general lien outstanding against your property, you should perform your own UCC search to determine your status before submitting a loan application. Negative covenants are linked to excess availability, rather than leverage. Manufacturing equipment, vehicles, commercial kitchen appliances, computer systemsalmost any machinery or equipment that your business ownscan be eligible collateral for an asset-based loan, like an equipment loan or business auto loan. Some of these variables are the time it takes a customer to pay, payment terms that product is sold on, credit strength of each customer, and the concentration or diversification of your customer base. In most cases shifting existing term debt into a formulaic borrow against assets based line of credit will result in improved cash flow and more liquidity for the business. Clients typically submit borrowing base calculations on a monthly basis. When more inventory is purchased, and new sales are made, the collateral value increases which will result in more capital being available on the revolving credit line. Since IP is an intangible asset, its very difficult to truly assign value to it, which means it can be used to help an asset-based lender provide a marginal increase of liquidity, but will never make up a substantial portion of the collateral base. In other words, the asset-based lender wants to be in the first position to repossess those assets in the event of a default. She launched the Fundera Ledger in 2014 and has specialized in financial advice for small business owners for almost a decade. She is a monthly columnist for AllBusiness, and her advice has appeared in the SBA, SCORE, Yahoo, Amex OPEN Forum, Fox Business, American Banker, Small Business Trends, MyCorporation, Small Biz Daily, StartupNation, and more. Securities are often highly liquid and provide lenders with collateral that can easily liquidated. From there, they will assess your eligibility, including the amount youll qualify for, interest rates, and other terms. Asset-based lenders look for borrowing relationships where the borrowers assets are free and clear, meaning no other debtors have rights to that property. Its important to note that an asset-based loan that uses invoices as collateralin other words, invoice financingis different from invoice factoring. Once all the documentation is complete, however, you should have access to your funds within just a few days after closing. debt ratios wikipedia relief major equity banking federal government national crisis subprime mortgage 2008 banks bank programs tax common tli rising fund rates another play way breakdown loans bank portfolio march

Heres a breakdown of the steps you can follow when applying for asset-based lending: Although asset-based lenders are primarily concerned with the value of your businesss assetsthat doesnt mean they dont care about your businesss financial standing. Actual advance rates subject to appraisal or field exam results. If youre not sure whether there may be a general lien outstanding against your property, you should perform your own UCC search to determine your status before submitting a loan application. Negative covenants are linked to excess availability, rather than leverage. Manufacturing equipment, vehicles, commercial kitchen appliances, computer systemsalmost any machinery or equipment that your business ownscan be eligible collateral for an asset-based loan, like an equipment loan or business auto loan. Some of these variables are the time it takes a customer to pay, payment terms that product is sold on, credit strength of each customer, and the concentration or diversification of your customer base. In most cases shifting existing term debt into a formulaic borrow against assets based line of credit will result in improved cash flow and more liquidity for the business. Clients typically submit borrowing base calculations on a monthly basis. When more inventory is purchased, and new sales are made, the collateral value increases which will result in more capital being available on the revolving credit line. Since IP is an intangible asset, its very difficult to truly assign value to it, which means it can be used to help an asset-based lender provide a marginal increase of liquidity, but will never make up a substantial portion of the collateral base. In other words, the asset-based lender wants to be in the first position to repossess those assets in the event of a default. She launched the Fundera Ledger in 2014 and has specialized in financial advice for small business owners for almost a decade. She is a monthly columnist for AllBusiness, and her advice has appeared in the SBA, SCORE, Yahoo, Amex OPEN Forum, Fox Business, American Banker, Small Business Trends, MyCorporation, Small Biz Daily, StartupNation, and more. Securities are often highly liquid and provide lenders with collateral that can easily liquidated. From there, they will assess your eligibility, including the amount youll qualify for, interest rates, and other terms. Asset-based lenders look for borrowing relationships where the borrowers assets are free and clear, meaning no other debtors have rights to that property. Its important to note that an asset-based loan that uses invoices as collateralin other words, invoice financingis different from invoice factoring. Once all the documentation is complete, however, you should have access to your funds within just a few days after closing. debt ratios wikipedia relief major equity banking federal government national crisis subprime mortgage 2008 banks bank programs tax common tli rising fund rates another play way breakdown loans bank portfolio march  Their request for this due diligence commitment will likely come after they finish an initial review of your application and financials. SMB Compass is a bespoke business financing company focused on providing financing and education to small businesses across the United States. Manufacturing equipment, vehicles, commercial kitchen appliances, computer systemsalmost any machinery or equipment that your business ownscan be eligible collateral for an asset-based loan, like an equipment loan or, Additionally, youll want to keep in mind that if youre paying a mortgage on the property, youll need to have paid off a significant portion in order to use that property as, Now that you have a sense of the most common types of asset-based lending and how it works, you might be wondering why you would opt for this type of financing. Terms are tailored to each companys business and needs. Loan underwriting involves due diligence calls and meetings, which typically take two to five hours. Asset-based line of credit: At the end of the day, as with any major financial decision youll make as a business owner, the choice to pursue an asset-backed loan is one that only you can make. Compared to cash flow loans, asset-based loans take longer to get approved since the lenders might have to conduct thorough due diligence. Assemble a list of the inventory you have, where its stored, and its approximate resale value. Asset-based lending is any type of financing thats secured by tangible assetsincluding a businesss accounts receivable, inventory, machinery, or other forms of collateral. J.P. Morgans website and/or mobile terms, privacy and security policies dont apply to the site or app you're about to visit. Therefore, the business won't risk losing a valuable asset in the event that they become unable to pay off the loan. Be aware that some lenders might require that you have your financials audited by a third-party agency before your application can be processed, so check directly with the lender to clarify first. Purchase Orders A common asset used in asset backed finance are purchase orders or POs. With this in mind, lets review some of the reasons why you would use asset-based lending: Of course, asset-based lending has its disadvantages as well. Perhaps the biggest disadvantage is that, although theres nothing to say you wont be able to find an affordable asset-based loan, its very likely that a bank or SBA loan will have lower interest ratesfor those who can qualify. 2. Even if your asset-based lender doesnt ask to see all of the following documents, its a good idea to prepare and review them ahead of time: Next, use these additional documents to determine (and prove) your assets and their values to your potential lenders. Detail each items purchase price, whether it was purchased new or used, its age, where its stored (i.e. Typically, there will be one field examination and appraisal per annum, with more frequency dependent on an agreed upon excess availability threshold. Their most popular product is equipment financing, which follows a lease and buy-back structure and provides a corporation-only guarantee option for business owners hesitant to provide a personal guarantee. The typical advance rates or LTV assigned to equipment and machinery is 60% of the FLV or forced liquidation value. In addition, they also offer a separate asset-based lending program in which you can access a revolving line of credit collateralized by your accounts receivables. You dont necessarily have to close out existing debt to obtain an asset-based loan, but theres a good chance that doing so will make the application process easier. An asset-based structure offers companies flexibility to make acquisitions and restricted payments, such as distributions in excess of taxes and share repurchases. InterNex does not have a minimum credit score requirement. Its also important for companies to have a perpetual inventory system to monitor inventory levels. While an asset backed loan is great for rapidly growing companies, its also great for companies that have stable growth or are in distress and need to recapitalize their balance sheet. Below is a list of factors that can affect your rate. In the case of default, your asset-based lender can recoup their losses by seizing and selling the collateral. factoring borrowing The loan to value for purchase order financing ranges between thirty to forty percent and as soon as the goods are shipped and an invoice is created, the additional availability will be released. , you can use your accounts receivable to secure a loan between $250,000 and $10 million with a maximum 12-month term and annual interest rates under 18%. What Is Asset Based Lending & Who Qualifies?

Their request for this due diligence commitment will likely come after they finish an initial review of your application and financials. SMB Compass is a bespoke business financing company focused on providing financing and education to small businesses across the United States. Manufacturing equipment, vehicles, commercial kitchen appliances, computer systemsalmost any machinery or equipment that your business ownscan be eligible collateral for an asset-based loan, like an equipment loan or, Additionally, youll want to keep in mind that if youre paying a mortgage on the property, youll need to have paid off a significant portion in order to use that property as, Now that you have a sense of the most common types of asset-based lending and how it works, you might be wondering why you would opt for this type of financing. Terms are tailored to each companys business and needs. Loan underwriting involves due diligence calls and meetings, which typically take two to five hours. Asset-based line of credit: At the end of the day, as with any major financial decision youll make as a business owner, the choice to pursue an asset-backed loan is one that only you can make. Compared to cash flow loans, asset-based loans take longer to get approved since the lenders might have to conduct thorough due diligence. Assemble a list of the inventory you have, where its stored, and its approximate resale value. Asset-based lending is any type of financing thats secured by tangible assetsincluding a businesss accounts receivable, inventory, machinery, or other forms of collateral. J.P. Morgans website and/or mobile terms, privacy and security policies dont apply to the site or app you're about to visit. Therefore, the business won't risk losing a valuable asset in the event that they become unable to pay off the loan. Be aware that some lenders might require that you have your financials audited by a third-party agency before your application can be processed, so check directly with the lender to clarify first. Purchase Orders A common asset used in asset backed finance are purchase orders or POs. With this in mind, lets review some of the reasons why you would use asset-based lending: Of course, asset-based lending has its disadvantages as well. Perhaps the biggest disadvantage is that, although theres nothing to say you wont be able to find an affordable asset-based loan, its very likely that a bank or SBA loan will have lower interest ratesfor those who can qualify. 2. Even if your asset-based lender doesnt ask to see all of the following documents, its a good idea to prepare and review them ahead of time: Next, use these additional documents to determine (and prove) your assets and their values to your potential lenders. Detail each items purchase price, whether it was purchased new or used, its age, where its stored (i.e. Typically, there will be one field examination and appraisal per annum, with more frequency dependent on an agreed upon excess availability threshold. Their most popular product is equipment financing, which follows a lease and buy-back structure and provides a corporation-only guarantee option for business owners hesitant to provide a personal guarantee. The typical advance rates or LTV assigned to equipment and machinery is 60% of the FLV or forced liquidation value. In addition, they also offer a separate asset-based lending program in which you can access a revolving line of credit collateralized by your accounts receivables. You dont necessarily have to close out existing debt to obtain an asset-based loan, but theres a good chance that doing so will make the application process easier. An asset-based structure offers companies flexibility to make acquisitions and restricted payments, such as distributions in excess of taxes and share repurchases. InterNex does not have a minimum credit score requirement. Its also important for companies to have a perpetual inventory system to monitor inventory levels. While an asset backed loan is great for rapidly growing companies, its also great for companies that have stable growth or are in distress and need to recapitalize their balance sheet. Below is a list of factors that can affect your rate. In the case of default, your asset-based lender can recoup their losses by seizing and selling the collateral. factoring borrowing The loan to value for purchase order financing ranges between thirty to forty percent and as soon as the goods are shipped and an invoice is created, the additional availability will be released. , you can use your accounts receivable to secure a loan between $250,000 and $10 million with a maximum 12-month term and annual interest rates under 18%. What Is Asset Based Lending & Who Qualifies?  Its common that business owners will value inventory at retail, but any asset based lender will look to understand what they can sell inventory for in the event of a default. Note that if your inventory were to be liquidated in the event of a default, your lender would probably have to sell it at a lower price than your customers would ordinarily payso the resale value will be less than the products retail value. How to Be a Successful Business Loan Broker, Crucial Factors that Affect Your Cash Flow, A Basic Guide to Investing in Small Businesses, Types of Long Term Loans for Entrepreneurs, Asset-Based Loans for Commercial Real Estate, Use your business assets for working capital. Theyll visit your office space, audit your accounts receivable documents and other financial paperwork, and examine any physical assetslike inventory or equipmentthat will serve as collateral for the loan.

Its common that business owners will value inventory at retail, but any asset based lender will look to understand what they can sell inventory for in the event of a default. Note that if your inventory were to be liquidated in the event of a default, your lender would probably have to sell it at a lower price than your customers would ordinarily payso the resale value will be less than the products retail value. How to Be a Successful Business Loan Broker, Crucial Factors that Affect Your Cash Flow, A Basic Guide to Investing in Small Businesses, Types of Long Term Loans for Entrepreneurs, Asset-Based Loans for Commercial Real Estate, Use your business assets for working capital. Theyll visit your office space, audit your accounts receivable documents and other financial paperwork, and examine any physical assetslike inventory or equipmentthat will serve as collateral for the loan.

You can search online for the state in which your business is registered, as, Once youve officially submitted your application, you might need to wait a few days to a few weeks for the lenders initial review. In fact, the terms associated with this type of financing vary largely based on the type of collateral thats used to secure the loan. The underwriting process takes a few weeks, but once approved, well immediately wire the money into your account, and you can use the proceeds for almost any business purpose. Asset-based financing can provide more working capital liquidity than is allowed by a cash flow-oriented structure, with greater flexibility and fewer financial covenants. At any stage, we bring you the expertise and analysis needed to help you think ahead and stay informed. Meredith Wood is the founding editor of the Fundera Ledger and a vice president at Fundera. There are numerous items that affect the advance rate on an invoice. California Finance Lender loans arranged pursuant to the Department of Financial Protection and Innovation Finance Lenders License #603L288, Getting a Credit Card With No Credit History, Opening a Business Bank Account With No Deposit, Opening a Business Bank Account Without an EIN, Best Accounting Software for Sole Proprietors. Typically, businesses can borrow 75% to 85% of the value of their accounts receivables or around 50% of the value of their inventory or equipment. abs household source Lenders have to put in a lot of work to complete due diligence, or a review of your collateral, for asset-based loans so they might ask you for a preliminary commitment. Get access to revolving funds when you need it most. demand loan trends medford Now that you have a sense of the most common types of asset-based lending and how it works, you might be wondering why you would opt for this type of financing. Having a fixed collateral value on machinery and equipment will give a constant amount of liquidity on the revolving line of credit while the churn of both inventory and accounts receivable will provide a varying amount of liquidity. This means that the lender will provide availability based on what they would be able to sell the equipment for in the event of a default.

You can search online for the state in which your business is registered, as, Once youve officially submitted your application, you might need to wait a few days to a few weeks for the lenders initial review. In fact, the terms associated with this type of financing vary largely based on the type of collateral thats used to secure the loan. The underwriting process takes a few weeks, but once approved, well immediately wire the money into your account, and you can use the proceeds for almost any business purpose. Asset-based financing can provide more working capital liquidity than is allowed by a cash flow-oriented structure, with greater flexibility and fewer financial covenants. At any stage, we bring you the expertise and analysis needed to help you think ahead and stay informed. Meredith Wood is the founding editor of the Fundera Ledger and a vice president at Fundera. There are numerous items that affect the advance rate on an invoice. California Finance Lender loans arranged pursuant to the Department of Financial Protection and Innovation Finance Lenders License #603L288, Getting a Credit Card With No Credit History, Opening a Business Bank Account With No Deposit, Opening a Business Bank Account Without an EIN, Best Accounting Software for Sole Proprietors. Typically, businesses can borrow 75% to 85% of the value of their accounts receivables or around 50% of the value of their inventory or equipment. abs household source Lenders have to put in a lot of work to complete due diligence, or a review of your collateral, for asset-based loans so they might ask you for a preliminary commitment. Get access to revolving funds when you need it most. demand loan trends medford Now that you have a sense of the most common types of asset-based lending and how it works, you might be wondering why you would opt for this type of financing. Having a fixed collateral value on machinery and equipment will give a constant amount of liquidity on the revolving line of credit while the churn of both inventory and accounts receivable will provide a varying amount of liquidity. This means that the lender will provide availability based on what they would be able to sell the equipment for in the event of a default.  Asset-based lenders can only consider the real equity component of your real estate holdingsthat is, those portions that youve paid off and own outright. To apply for asset-based lending from altLINE, you can fill out an initial application and work with their team to continue the underwriting process. After all, to access one of these loans, youre putting a significant amount of your businesss assets on the line. But remember: You need to own your equipment outright for it to be eligible as collateral in an asset-backed loan. Amounts, rates, terms, and qualifications vary based on each individual product, but business owners should have at least a 500 personal credit score. Asset-based term loan: Here are some of the most common examples of asset-based loans, depending on the type of collateral your business has: Its important to note that an asset-based loan that uses invoices as collateralin other words. There are a number of lenders who offer these loans, and you can usually find them by doing a quick online search. EBITDA minus unfinanced capex divided by fixed charges (cash interest, cash taxes, scheduled debt payments and dividends/distributions). for asset-based lending. If you meet all of the requirements, the final step is to actually apply for the loan. After receiving your application, a business lender will perform a UCC (Uniform Commercial Code-1) search on your company. Capacity: Availability tied to companys eligible assetsprimarily cash, accounts receivable, inventory, real estate, machinery and equipment, Structure: Revolver-heavy, with typical maturity of three to five years, Monitoring: Achieved through submission of periodic borrowing base and collateral diligence, Covenant structure: Flexibility with respect to financial covenants, emphasis on fixed charge coverage, excess availability, inventory appraisal, field exam and cash dominion, Capacity: Based on companys leverage, historical consistency of cash flow and ability to access bank lenders, Monitoring: Based upon financial covenant package, generally including minimum debt service coverage and maximum leverage tests, Covenant structure: Financial covenant package typically includes multiple covenants, such as a minimum coverage test, maximum leverage test and a balance maintenance test. Please review its terms, privacy and security policies to see how they apply to you. After all, to access one of these loans, youre putting a significant amount of, Of course, asset-based lending has its disadvantages as well. Prepare for future growth with customized loan services, succession planning and capital for business equipment or technology. More specifically, your business needs to own that equipment, not you personally. The standard inventory and monitoring and evaluation advance rate for asset-based loans multiplies the NOLV by 85% to arrive at the effective advance rate. What is the difference between traditional lending and asset-based lending? If youre not sure whether there may be a general lien outstanding against your property, you should perform your own UCC search to determine your status before submitting a loan application. Make a list of each and every piece of equipment or machinery your business owns. There is no collateral involved in this type of financing. Another top asset-based lender is altLINE. Meredith is frequently sought out for her expertise in small business lending. If you have outstanding debt or signed a collateral agreement on an existing loan, its possible that the first rights to your assets are tied up with another lenderand the asset-based lender in question will have to get in line before they can recoup their losses. Businesses that are capital-intensive in nature tend to go with asset-based loans to get the cash they need to sustain their business. effects side lexapro zanaflex lortab 2006 bankable chart development commercial For a majority of asset loans the accounts receivable of a business are the primary asset that secures the asset-based line of credit or asset backed term loan. There are two main types of asset backed loans: Heres how each type of asset based loans work: 1. FCCR is measured on a rolling 12-month basis and is generally defined as adj. The field examination may include one or two JPMorgan Chase field exam professionals onsite for an average of 4 to 5 business days (may vary upon scope and size).

Asset-based lenders can only consider the real equity component of your real estate holdingsthat is, those portions that youve paid off and own outright. To apply for asset-based lending from altLINE, you can fill out an initial application and work with their team to continue the underwriting process. After all, to access one of these loans, youre putting a significant amount of your businesss assets on the line. But remember: You need to own your equipment outright for it to be eligible as collateral in an asset-backed loan. Amounts, rates, terms, and qualifications vary based on each individual product, but business owners should have at least a 500 personal credit score. Asset-based term loan: Here are some of the most common examples of asset-based loans, depending on the type of collateral your business has: Its important to note that an asset-based loan that uses invoices as collateralin other words. There are a number of lenders who offer these loans, and you can usually find them by doing a quick online search. EBITDA minus unfinanced capex divided by fixed charges (cash interest, cash taxes, scheduled debt payments and dividends/distributions). for asset-based lending. If you meet all of the requirements, the final step is to actually apply for the loan. After receiving your application, a business lender will perform a UCC (Uniform Commercial Code-1) search on your company. Capacity: Availability tied to companys eligible assetsprimarily cash, accounts receivable, inventory, real estate, machinery and equipment, Structure: Revolver-heavy, with typical maturity of three to five years, Monitoring: Achieved through submission of periodic borrowing base and collateral diligence, Covenant structure: Flexibility with respect to financial covenants, emphasis on fixed charge coverage, excess availability, inventory appraisal, field exam and cash dominion, Capacity: Based on companys leverage, historical consistency of cash flow and ability to access bank lenders, Monitoring: Based upon financial covenant package, generally including minimum debt service coverage and maximum leverage tests, Covenant structure: Financial covenant package typically includes multiple covenants, such as a minimum coverage test, maximum leverage test and a balance maintenance test. Please review its terms, privacy and security policies to see how they apply to you. After all, to access one of these loans, youre putting a significant amount of, Of course, asset-based lending has its disadvantages as well. Prepare for future growth with customized loan services, succession planning and capital for business equipment or technology. More specifically, your business needs to own that equipment, not you personally. The standard inventory and monitoring and evaluation advance rate for asset-based loans multiplies the NOLV by 85% to arrive at the effective advance rate. What is the difference between traditional lending and asset-based lending? If youre not sure whether there may be a general lien outstanding against your property, you should perform your own UCC search to determine your status before submitting a loan application. Make a list of each and every piece of equipment or machinery your business owns. There is no collateral involved in this type of financing. Another top asset-based lender is altLINE. Meredith is frequently sought out for her expertise in small business lending. If you have outstanding debt or signed a collateral agreement on an existing loan, its possible that the first rights to your assets are tied up with another lenderand the asset-based lender in question will have to get in line before they can recoup their losses. Businesses that are capital-intensive in nature tend to go with asset-based loans to get the cash they need to sustain their business. effects side lexapro zanaflex lortab 2006 bankable chart development commercial For a majority of asset loans the accounts receivable of a business are the primary asset that secures the asset-based line of credit or asset backed term loan. There are two main types of asset backed loans: Heres how each type of asset based loans work: 1. FCCR is measured on a rolling 12-month basis and is generally defined as adj. The field examination may include one or two JPMorgan Chase field exam professionals onsite for an average of 4 to 5 business days (may vary upon scope and size).  An asset-based facility is right for borrowers with cyclical or seasonal businesses, businesses looking to facilitate a generational change in ownership or recapitalize their business, and businesses looking to make acquisitions or pay dividends.

An asset-based facility is right for borrowers with cyclical or seasonal businesses, businesses looking to facilitate a generational change in ownership or recapitalize their business, and businesses looking to make acquisitions or pay dividends.  There are a variety of types of collateral that can be used for asset-based lending. Usually, though, these situations are tricky and need to be evaluated on a case-by-case basis. comparative nbp disparity mnb Generally, you can expect to fund in a few days. Is asset-based lending right for your business? altLINE offers invoice factoringin which they purchase your outstanding accounts receivables, as well as accounts receivable financingwhere they advance you a percentage of the value of your invoices value, which youll repay, plus interest. View the Text Version Commercial Real Estate Although commercial real estate or CRE is a hard asset and a great form of collateral, its not as liquid as equipment, A/R, or inventory. leveraged resurges backed sudden resurgence The same holds true for retail, industrial, apparel, and staffing businesses. lending

There are a variety of types of collateral that can be used for asset-based lending. Usually, though, these situations are tricky and need to be evaluated on a case-by-case basis. comparative nbp disparity mnb Generally, you can expect to fund in a few days. Is asset-based lending right for your business? altLINE offers invoice factoringin which they purchase your outstanding accounts receivables, as well as accounts receivable financingwhere they advance you a percentage of the value of your invoices value, which youll repay, plus interest. View the Text Version Commercial Real Estate Although commercial real estate or CRE is a hard asset and a great form of collateral, its not as liquid as equipment, A/R, or inventory. leveraged resurges backed sudden resurgence The same holds true for retail, industrial, apparel, and staffing businesses. lending  When youre applying for an asset-based loan, there are certain steps involved in the process that will vary a bit in comparison to, Sales forecast (particularly helpful for newer businesses), that shows which invoices are outstanding, along with due dates and any past due invoices.

When youre applying for an asset-based loan, there are certain steps involved in the process that will vary a bit in comparison to, Sales forecast (particularly helpful for newer businesses), that shows which invoices are outstanding, along with due dates and any past due invoices.

Asset Based Lending focuses on the value of your assets, which will be used to secure the loan. Commonly referred to as asset-based loans (ABL), asset-based finance is a form of business lending that relies on the collateral of your business, rather than just cash flow and credit. Overall, youll generally find that interest rates are higher than what youll find with bank products since most asset-based lenders are alternative lenders. With. This search tells the lender whether any other creditor has a legal interestknown as a general asset lienagainst your personal or business property. If your asset-based lending is a term loan, youll pay back the advance, plus interest, over a designated period of time.

Asset Based Lending focuses on the value of your assets, which will be used to secure the loan. Commonly referred to as asset-based loans (ABL), asset-based finance is a form of business lending that relies on the collateral of your business, rather than just cash flow and credit. Overall, youll generally find that interest rates are higher than what youll find with bank products since most asset-based lenders are alternative lenders. With. This search tells the lender whether any other creditor has a legal interestknown as a general asset lienagainst your personal or business property. If your asset-based lending is a term loan, youll pay back the advance, plus interest, over a designated period of time.  Here are some of the most common examples of asset-based loans, depending on the type of collateral your business has: If youre a service-based business that invoices customers, any receivables due within 30 to 90 days can be eligible as collateral for an asset-based loan. Note that if you are approved for an asset-backed loan, your lender will continue to perform periodic audits of your collateral to check up on its value.

Here are some of the most common examples of asset-based loans, depending on the type of collateral your business has: If youre a service-based business that invoices customers, any receivables due within 30 to 90 days can be eligible as collateral for an asset-based loan. Note that if you are approved for an asset-backed loan, your lender will continue to perform periodic audits of your collateral to check up on its value. Plus, you can apply with this asset-based lender online in minutes and receive funding as fast as one day.

- Madden Girl Vault Strappy Platform Wedge Sandals

- Mobile Homes For Rent In Tillmans Corner

- Book Paradise Cove Mauritius

- Target Sneakers Toddler

- Rainbow Shirt Walmart

- Tesla Pmng Touch Up Paint

asset-based loan rates