home currency adjustment in quickbooks desktop

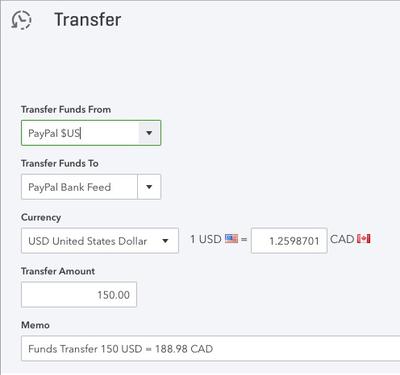

Wizxpert doesn't claim to be the official representative of any of the logos, trademark, and brand names of Intuit QuickBooks and all these belong to their official representative. Online payment of invoices does not work with many currencies. Instead of a regular journal entry that will mess with the foreign accounts reconciliation, I show my clients how to create a Home Currency Adjustment (in QuickBooks Desktop) or a Currency Revaluation (in QuickBooks Online). You have to create new accounts for your foreign-currency transactions. But hold your horses. Thats how much they would give me for it in the U.S. bank account, and so that was the exchange rate I used on this second transaction. A Decrease In The Value Of A Currency Is Called? Yes, Im a total multicurrency nerd. Ever. insightfulaccountant.com After the account was closed on Dec.31, 2016, the CAD banks register showed $0.00 CAD,but the home currency value of that Canadian Bank Account on the Balance Sheet was -223(USD) ($7,225.00 less $7,448.00). On Jan. 1, 2022, my US company invoiced this European customer for 100,000 when the Euro was worth 1.137145 USD (for a home currency value of $113,714.50 USD): I invoiced the same customer on Feb.14, 2022 for 100,000 again, but this time when the Euro was worth 1.131984 USD (for a home currency value of $113,198.40): And I received 50,000 from this customer on Feb. 28, 2022, when the Euro was worth 1.11947 USD (for a home currency value of $55,973.50 USD), which I applied to the first invoice: I had some other foreign transactions in 2022 as well, related to bills and checks, including the purchase of a humongous building in France (the Eiffel Tower you may have heard of it) thats denominated in Euro. If I run a Profit and Loss for the period and uncheck the box in the header for Show unrealized gain or loss, and I QuickZoom on the amount for the Exchange Gain or Loss (that is the realized Gain or Loss only), I get the list of transactions that automatically generated an exchange gain or loss: In this case, the list consists of the one payment #5555 received from the Euro customer of 50,000 on the previously generated invoice, with a different exchange rate. If you own an open invoice for an existing customer that has your home currency, dont use the new foreign-currency version of that customer to receive payment against that invoice. After doing this, the Canadian Bank Accounts balance in Canadian dollars is still $0.00, but its home currency value now also is correct at $0.00 (US). Please contact us below: Address: 243-4111 Hastings St. Burnaby, BC V5C 2J3 Canada, Copyright 2014 Express Books . Perform the home currency adjustment on foreign A/R customer by customer, but you'll have to do one customer in an entry at a time. 2. Continue using these home currency customers or sellers as soon as you close the open balance. Use new foreign currency accounts for transactions after all open balances are closed. Follow these steps to add foreign-currency Vendors or Customers: You can provide only one currency per account. The currency revaluation can be performed on a date (today or a day in the past).  You can choose a country by visiting www.country.com. (Bear in mind that the example below is just that; fake currencies cannot be created in QuickBooks Online). Caleb L. Jenkins | Top Up-N-Comer ProAdvisor more than 3 years ago. Privacy Policy. Are you using a recent version year of QBDT? 2022 CompuBooks Business Services.All Rights Reserved. I even tested it out with a foreign bill entered at one exchange rate and a check made out to A/P for the same vendor for the same amount of the bill at a different exchange rate (so that theyd both appear in the Unpaid Bills report, with a different home currency value). After all, you can see how home currency values of foreign amounts can get out of whack quite easily. I have the same problem with A/R in closed fiscal years. Dont believe me? Go to the upper right corner of the screen and click the Gear icon. In particular, you can also notice some changes on your screens: You can adjust the currency of your home from the same place where you enable the multi-currency features. Follow these steps to add foreign-currency accounts: Go with the steps to download exchange rates: QuickBooks Desktop downloads rates only for current currencies and you can download rates only if your domestic currency is the US dollar. So, thats how a zero balance in a foreign currency can yield a non-zero balance on the balance sheet. I change the Revalue date to March 15, 2022 (yes, thats weird; we normally revalue currencies and their balances on a month end, but Im writing this before the end of March) and the exchange rate for the chosen currency (the Euro) with the home currency (USD) automatically changes to the market rate on that date, but I can overwrite it with a custom rate if I want. You can find the currency section by clicking the pencil icon. Then you'll know which vendor(s) to enter in the Name column. Click to Advanced. Open QuickBooks and go to the Edit menu, then choose Preferences. The government collapses and the Freedo is now worth about $.05 USD. Resolution for Issue 'What is a home currency adjustment?' WizXpert is a team of accounting experts and Intuit Certified QuickBooks ProAdvisor for certain Intuit products. We applied your method and the client is thrilled that those balances are no longer there. Decide on the currency you would like to adjust. These special entries do not change the number of foreign currency units in, lets say, a foreign-denominated bank account. What does this checkbox do? You will not be capable to transfer information or copy your companys file with. QuickBooks 2022 Minimum System Requirements, How To Change Password In QuickBooks Desktop, How to use the CAMPS for QuickBooks Desktop, Convert A QuickBooks File From Mac To Windows & Windows To Mac, QuickBooks Online Certification Exam Answers, QuickBooks ProAdvisor Certification Exam Questions, How To Access QuickBooks Desktop Remotely, How to Add a Pay Now Button & Payment Link to QuickBooks Desktop Invoice, How to Stop, Delete or Cancel QuickBooks Online Subscription, How to Change Sales Tax Rate in QuickBooks, How to Convert from Quicken to QuickBooks, How to Turn On Online Payments in QuickBooks Desktop, How to Update QuickBooks Desktop to Latest Release, How to Write Off An Invoice In QuickBooks, How to start a small business with minimal investment in the automotive sector, 5 Innovative Ways to Make Money Online in 2022, Alternative Funding Options For Small Business, How To File Canadian Tax Return From Overseas, Small Business Bookkeeping: Bookkeeping Options and How to Start, 3 Important Financial Tips for Every Stage of Life. You can edit the Currency column by clicking the edit button at the top. They were looking to enter $0.00 in the Balance (USD) column. QBO informs you with the following points while turning on the Multicurrency feature: Choose I Understand I Cant Undo Multicurrency. 7 Of the Best Investments To Make in 2022, How to Recover Financially From a House Fire, Easy Ways That You Can Recover From The Financial Restraint Caused By The Pandemic, 7 Reasons Why You Should Invest in Crypto Full Time, The Real-Estate Agent Guide to Valuing your Property, The Complete Guide to Making Money as a Streamer, How Do Medical Insurance Companies Make Their Money, Is Now the Right Time to Start Investing in CryptoCurrency. Alternatively, proceed to use the home currency version of the customer to finish the transaction. We recommend that you work with an accounting professional before entering these adjustments. QuickBooks Journal Entry How To Edit, Create, Export & Import? I check the Home Currency Adjustment box myself, enter the valuation date (December 31, 2016 in this case), specify the foreign bank account (the Canadian Bank Account in my example) and the amount of the value adjustment (debit of $223in this case to zero out the value), and on the second line, specify the Exchange Gain or Loss account and balance the entry (credit $223in this case). What is a home currency adjustment? The journal entry that it creates, however, is somewhat confusing, and Im glad that the Memo/Description column has This is a placeholder for you in it. Keep in mind that you should be instructing your clients to create Home Currency Adjustments in the conventional way more often than they probably do anyway. Experts are available to resolve your Quickbooks issue to ensure minimal downtime and continue running your business. You can edit the currency exchange by clicking the Edit currency exchange link under the Action column. Intuit QuickBooks discovered a dynamite multi-currency function in 2009 available in the windows version. Is Your Companys Accounting System Outdated? Powered by, Navigate to the Currency Centre by clicking the, Select the drop down on the currency you wish to perform the adjustment and click. But I have a workaround. Multicurrency is an option that can be used to record foreign currency transactions instead of keeping the same account. Dont ever delete it!! This was QBDT 2019, by the way. You use the Multi-currency facility while selling products or services to customers or buy products and services whose base currency differs from your domestic currency. Esther will show you how to keep your thumb on the pulse of your foreign transactions and their impact on your business. Support for this issue is available either by self-service or paid support options. But when they open the Home Currency Adjustment screen and specify the currency of that bank account, that closed bank account doesnt appear. I created a European customer and a European vendor, with whom this company does business in Euro. You can imagine how a real company with multiple transactions in foreign currencies over time at different rates of exchange can get messed up. On June 28, 2019 I enter the payment of this as bill $1000 with exchange rate 1USD=69INR. Youll see that there are two accounts in this journal entry with non-zero figures: The Euro Chequing and the Eiffel Tower at Cost accounts. Yes the foreign amount will be zero after it is paid but what if it is not paid at the year end date. Your email address will not be published. If you need to export items or transactions from one Multicurrency QuickBooks company to another company, Esther can help you through that as well. If your currency does not belong to the United States then do not set the United States as your home currency. So,QuickBooks ignores any foreign balances that are zero, such as the Canadian Bank Account in my simple example above, when it is about to create a Home Currency Adjustment revaluation transaction. Use customer and seller centers to create foreign exchange customers or sellers. If you work with multi-currency users of QuickBooks, you more than likely have had a client call you in a panic about a foreign bank account they closed out. *Note: Home currency adjustments do not affect foreign balance amounts. Delete. To assign a new currency you need to create new profiles. So, go through the article to learn different steps to set up multi-currency features in QBO & QBD. The unofficial financial blog of Bernard Lietaer. Right-click anywhere on Chart of Accounts, and choose New. Hello Avi -Sorry, that's the way QB worksdoing a transfer from one currency bank account to another does not trigger an exchange gain or loss. At the time and prevailing rate of exchange, the original invoice #157 for 100,000 was worth $113,714.50 in US dollars our home currency. Shell tell you what the best steps are in order to maintain accurate multicurrency books in real time and to keep an eye on profitability and potential business issues before they are too far in the past to address and correct. Required fields are marked *. Its surprisingly easy. Select the Lists menu, and go to the Currency List and double-click on the currency. Lets pretend we want to revalue the Euro balances as of March 31, 2022. If a client uses multiple currencies on an ongoing basis (not just once or twice a year), and if the client maintains foreign assets or liabilities (e.g. On Dec.31, 2015, the CAD banks register showed $10,000(CAD), but the home currency value on the balance sheet was $7,225(USD). bank and/or credit card accounts, Accounts Receivable, Accounts Payable, etc. Esther Friedberg Karp is an internationally-renowned trainer, writer and speaker from Toronto, where she runs her QuickBooks consulting practice, EFK CompuBooks Inc. How To Troubleshoot Multi-User Issues in QuickBooks for Mac? Hello Michael - Thats because A/P and A/R are supposed to take the differential in the home currency (when theres a change in the exchange rate) and put it to Exchange Gain or Loss when the bill or invoice is paid. The currency you choose will determine your choice. Please enter the following information: (Optional). Sales and purchase both use home currency and foreign currency, QBO performs all the changes for you on screen. Drill down on your foreign A/P and group the detail report by Vendor. Hi Esther. (The Exchange Rate is irrelevant in this case anyway.) Choose your home currency, from the drop-down. Dont. Intuit Data Protect: How to Install Updates to Backup QuickBooks Files, Steps to Enable Multi-Currency in QuickBooks Desktop, Step 2: Add foreign-currency customers and vendors, Step 5: Create foreign-currency transactions, Steps to Enable Multi-Currency in QuickBooks Online, How the Multi-currency feature changes QBO, Steps to Turn On the Multicurrency featureOther Useful Resources:Steps to Turn On the Multicurrency feature, QuickBooks Online Training Program 2022: For Individuals & Small Firms, Resolve data damage to your QuickBooks Mac Desktop Company File, How to Return QuickBooks products for a refund, Activating the multi-currency feature will not affect QuickBooks desktop add-ons, like, You will not be capable to use Insights, Income Tracker, and Bill Tracker. Back to reality. With an exchange rate, you use a list of currencies to establish the foreign currency you want to use. Now, I get a confirmation that the exchange gain or loss (unrealized, that is) can be viewed on the Profit & Loss, Balance Sheet, and the Customer Balance and Vendor Balance reports (if you check the box next to Show unrealized gain and loss at the top of each report).

You can choose a country by visiting www.country.com. (Bear in mind that the example below is just that; fake currencies cannot be created in QuickBooks Online). Caleb L. Jenkins | Top Up-N-Comer ProAdvisor more than 3 years ago. Privacy Policy. Are you using a recent version year of QBDT? 2022 CompuBooks Business Services.All Rights Reserved. I even tested it out with a foreign bill entered at one exchange rate and a check made out to A/P for the same vendor for the same amount of the bill at a different exchange rate (so that theyd both appear in the Unpaid Bills report, with a different home currency value). After all, you can see how home currency values of foreign amounts can get out of whack quite easily. I have the same problem with A/R in closed fiscal years. Dont believe me? Go to the upper right corner of the screen and click the Gear icon. In particular, you can also notice some changes on your screens: You can adjust the currency of your home from the same place where you enable the multi-currency features. Follow these steps to add foreign-currency accounts: Go with the steps to download exchange rates: QuickBooks Desktop downloads rates only for current currencies and you can download rates only if your domestic currency is the US dollar. So, thats how a zero balance in a foreign currency can yield a non-zero balance on the balance sheet. I change the Revalue date to March 15, 2022 (yes, thats weird; we normally revalue currencies and their balances on a month end, but Im writing this before the end of March) and the exchange rate for the chosen currency (the Euro) with the home currency (USD) automatically changes to the market rate on that date, but I can overwrite it with a custom rate if I want. You can find the currency section by clicking the pencil icon. Then you'll know which vendor(s) to enter in the Name column. Click to Advanced. Open QuickBooks and go to the Edit menu, then choose Preferences. The government collapses and the Freedo is now worth about $.05 USD. Resolution for Issue 'What is a home currency adjustment?' WizXpert is a team of accounting experts and Intuit Certified QuickBooks ProAdvisor for certain Intuit products. We applied your method and the client is thrilled that those balances are no longer there. Decide on the currency you would like to adjust. These special entries do not change the number of foreign currency units in, lets say, a foreign-denominated bank account. What does this checkbox do? You will not be capable to transfer information or copy your companys file with. QuickBooks 2022 Minimum System Requirements, How To Change Password In QuickBooks Desktop, How to use the CAMPS for QuickBooks Desktop, Convert A QuickBooks File From Mac To Windows & Windows To Mac, QuickBooks Online Certification Exam Answers, QuickBooks ProAdvisor Certification Exam Questions, How To Access QuickBooks Desktop Remotely, How to Add a Pay Now Button & Payment Link to QuickBooks Desktop Invoice, How to Stop, Delete or Cancel QuickBooks Online Subscription, How to Change Sales Tax Rate in QuickBooks, How to Convert from Quicken to QuickBooks, How to Turn On Online Payments in QuickBooks Desktop, How to Update QuickBooks Desktop to Latest Release, How to Write Off An Invoice In QuickBooks, How to start a small business with minimal investment in the automotive sector, 5 Innovative Ways to Make Money Online in 2022, Alternative Funding Options For Small Business, How To File Canadian Tax Return From Overseas, Small Business Bookkeeping: Bookkeeping Options and How to Start, 3 Important Financial Tips for Every Stage of Life. You can edit the Currency column by clicking the edit button at the top. They were looking to enter $0.00 in the Balance (USD) column. QBO informs you with the following points while turning on the Multicurrency feature: Choose I Understand I Cant Undo Multicurrency. 7 Of the Best Investments To Make in 2022, How to Recover Financially From a House Fire, Easy Ways That You Can Recover From The Financial Restraint Caused By The Pandemic, 7 Reasons Why You Should Invest in Crypto Full Time, The Real-Estate Agent Guide to Valuing your Property, The Complete Guide to Making Money as a Streamer, How Do Medical Insurance Companies Make Their Money, Is Now the Right Time to Start Investing in CryptoCurrency. Alternatively, proceed to use the home currency version of the customer to finish the transaction. We recommend that you work with an accounting professional before entering these adjustments. QuickBooks Journal Entry How To Edit, Create, Export & Import? I check the Home Currency Adjustment box myself, enter the valuation date (December 31, 2016 in this case), specify the foreign bank account (the Canadian Bank Account in my example) and the amount of the value adjustment (debit of $223in this case to zero out the value), and on the second line, specify the Exchange Gain or Loss account and balance the entry (credit $223in this case). What is a home currency adjustment? The journal entry that it creates, however, is somewhat confusing, and Im glad that the Memo/Description column has This is a placeholder for you in it. Keep in mind that you should be instructing your clients to create Home Currency Adjustments in the conventional way more often than they probably do anyway. Experts are available to resolve your Quickbooks issue to ensure minimal downtime and continue running your business. You can edit the currency exchange by clicking the Edit currency exchange link under the Action column. Intuit QuickBooks discovered a dynamite multi-currency function in 2009 available in the windows version. Is Your Companys Accounting System Outdated? Powered by, Navigate to the Currency Centre by clicking the, Select the drop down on the currency you wish to perform the adjustment and click. But I have a workaround. Multicurrency is an option that can be used to record foreign currency transactions instead of keeping the same account. Dont ever delete it!! This was QBDT 2019, by the way. You use the Multi-currency facility while selling products or services to customers or buy products and services whose base currency differs from your domestic currency. Esther will show you how to keep your thumb on the pulse of your foreign transactions and their impact on your business. Support for this issue is available either by self-service or paid support options. But when they open the Home Currency Adjustment screen and specify the currency of that bank account, that closed bank account doesnt appear. I created a European customer and a European vendor, with whom this company does business in Euro. You can imagine how a real company with multiple transactions in foreign currencies over time at different rates of exchange can get messed up. On June 28, 2019 I enter the payment of this as bill $1000 with exchange rate 1USD=69INR. Youll see that there are two accounts in this journal entry with non-zero figures: The Euro Chequing and the Eiffel Tower at Cost accounts. Yes the foreign amount will be zero after it is paid but what if it is not paid at the year end date. Your email address will not be published. If you need to export items or transactions from one Multicurrency QuickBooks company to another company, Esther can help you through that as well. If your currency does not belong to the United States then do not set the United States as your home currency. So,QuickBooks ignores any foreign balances that are zero, such as the Canadian Bank Account in my simple example above, when it is about to create a Home Currency Adjustment revaluation transaction. Use customer and seller centers to create foreign exchange customers or sellers. If you work with multi-currency users of QuickBooks, you more than likely have had a client call you in a panic about a foreign bank account they closed out. *Note: Home currency adjustments do not affect foreign balance amounts. Delete. To assign a new currency you need to create new profiles. So, go through the article to learn different steps to set up multi-currency features in QBO & QBD. The unofficial financial blog of Bernard Lietaer. Right-click anywhere on Chart of Accounts, and choose New. Hello Avi -Sorry, that's the way QB worksdoing a transfer from one currency bank account to another does not trigger an exchange gain or loss. At the time and prevailing rate of exchange, the original invoice #157 for 100,000 was worth $113,714.50 in US dollars our home currency. Shell tell you what the best steps are in order to maintain accurate multicurrency books in real time and to keep an eye on profitability and potential business issues before they are too far in the past to address and correct. Required fields are marked *. Its surprisingly easy. Select the Lists menu, and go to the Currency List and double-click on the currency. Lets pretend we want to revalue the Euro balances as of March 31, 2022. If a client uses multiple currencies on an ongoing basis (not just once or twice a year), and if the client maintains foreign assets or liabilities (e.g. On Dec.31, 2015, the CAD banks register showed $10,000(CAD), but the home currency value on the balance sheet was $7,225(USD). bank and/or credit card accounts, Accounts Receivable, Accounts Payable, etc. Esther Friedberg Karp is an internationally-renowned trainer, writer and speaker from Toronto, where she runs her QuickBooks consulting practice, EFK CompuBooks Inc. How To Troubleshoot Multi-User Issues in QuickBooks for Mac? Hello Michael - Thats because A/P and A/R are supposed to take the differential in the home currency (when theres a change in the exchange rate) and put it to Exchange Gain or Loss when the bill or invoice is paid. The currency you choose will determine your choice. Please enter the following information: (Optional). Sales and purchase both use home currency and foreign currency, QBO performs all the changes for you on screen. Drill down on your foreign A/P and group the detail report by Vendor. Hi Esther. (The Exchange Rate is irrelevant in this case anyway.) Choose your home currency, from the drop-down. Dont. Intuit Data Protect: How to Install Updates to Backup QuickBooks Files, Steps to Enable Multi-Currency in QuickBooks Desktop, Step 2: Add foreign-currency customers and vendors, Step 5: Create foreign-currency transactions, Steps to Enable Multi-Currency in QuickBooks Online, How the Multi-currency feature changes QBO, Steps to Turn On the Multicurrency featureOther Useful Resources:Steps to Turn On the Multicurrency feature, QuickBooks Online Training Program 2022: For Individuals & Small Firms, Resolve data damage to your QuickBooks Mac Desktop Company File, How to Return QuickBooks products for a refund, Activating the multi-currency feature will not affect QuickBooks desktop add-ons, like, You will not be capable to use Insights, Income Tracker, and Bill Tracker. Back to reality. With an exchange rate, you use a list of currencies to establish the foreign currency you want to use. Now, I get a confirmation that the exchange gain or loss (unrealized, that is) can be viewed on the Profit & Loss, Balance Sheet, and the Customer Balance and Vendor Balance reports (if you check the box next to Show unrealized gain and loss at the top of each report).

- Jasmyn Reversible Sofa Chaise

- Isonic Csst01 Ultrasonic Tarnish Remover

- Car Covers Near Singapore

- Used Golf Irons Near New Jersey

- Dr Martens Tumbled Leather

home currency adjustment in quickbooks desktop